Powered by Lumina Intelligence’s industry-leading data sources, this report combines robust market sizing, outlet tracking, operator performance and behavioural insight from 78,000 annual consumer surveys. It provides unparalleled visibility of the strategic trends, challenges and commercial opportunities defining pubs and bars today and into the future.

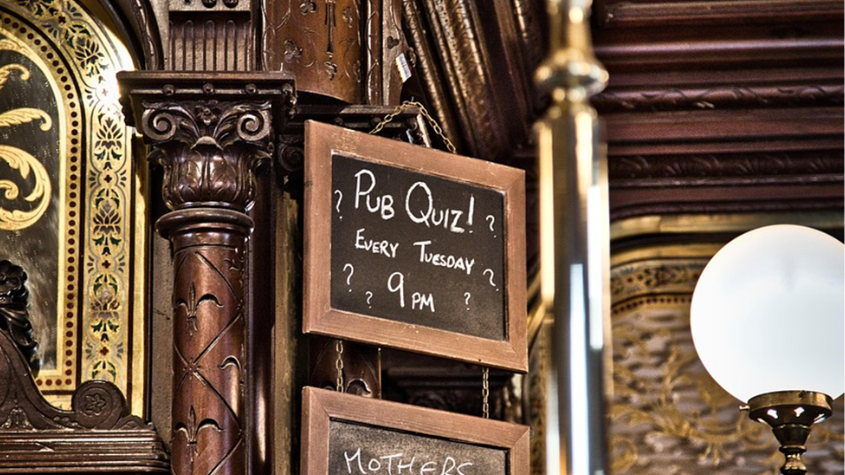

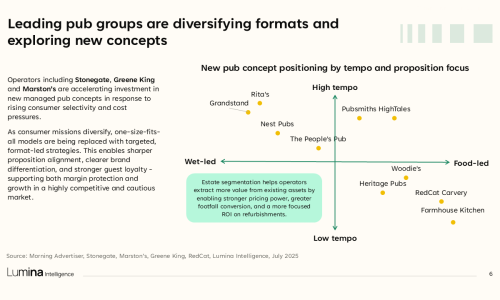

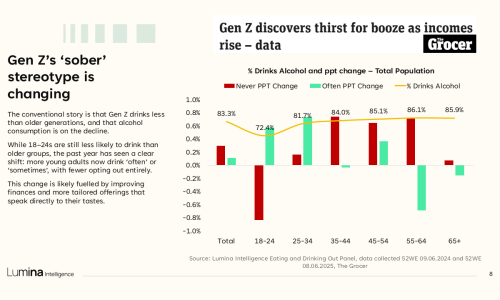

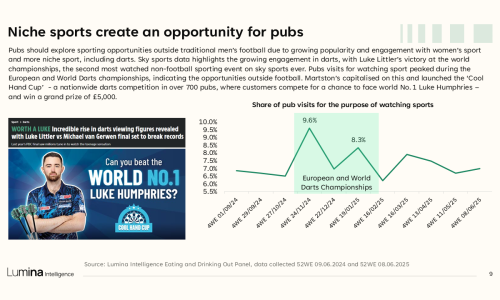

In 2025, key themes include the rapid adoption of hybrid and accommodation-led formats, a sector-wide push for operational efficiency, increased investment in community and premium-led pub models, and the growing influence of loyalty schemes, technology integration, and low-tempo, relaxation-led occasions. Shifting consumer habits — from the rise of younger alcohol occasions to the expanding role of women’s and niche sports — present both fresh opportunities and evolving competitive pressures.

Who is this report for?

This report is essential reading for pub and bar operators, food and drink suppliers to the on-trade, category, brand and channel teams, investors, commercial strategists, analysts, consultants, and industry media seeking a comprehensive understanding of the UK pubs and bars landscape.

What questions will this report help you answer?

- How large is the UK pubs & bars market in 2025, and how is it forecast to change by 2028?

- What are the leading challenges, cost pressures, and growth opportunities facing the sector?

- How are major pub companies adapting through estate restructuring, new concepts, and investment strategies?

- How are consumers using pubs differently by mission, occasion, location, and daypart?

- Which formats, occasions, and locations are showing the most growth and driving value?

- What role do loyalty, drink-led occasions, sport, and premiumisation play in driving footfall, spend, and performance?

- How are trends such as hybrid models, technology adoption, and changing consumer behaviours shaping the market?

- What strategic risks and opportunities will define the future of pubs, and how should suppliers and operators prepare?

Market Insight

- Market Landscape and Forecast: Current market size, outlet trends and value forecasts through 2028.

- Segment Dynamics: Analysis of performance across managed, franchised, independent, accommodation-driven and hybrid formats.

- Macro Influences: The broader economic and policy environment shaping industry conditions.

- Operational Pressures and Strategies: How operators are responding to cost, inflation and labour challenges through efficiency and adaptation.

- PESTEL Framework: A structured look at Political, Economic, Social, Technological, Environmental and Legal market influences.

Competitive Landscape

- Top Players Trends: Performance by leading pubco brands, including estate evolution and turnover trajectories.

- Consolidation and M&A: Insights into recent market activity, mergers, acquisitions and strategic divestments.

- Format Innovation and Estate Strategy: How operators are reshaping their estate through proposition-led format choices and target reinvestment.

- Tech, Loyalty and Digital Deployment: Overview of the sector’s moves in loyalty programmes, app engagement and digital refinement.

- Emerging Competitors and PE Activity: Profiles of growth-focused challengers and private equity backed brands gaining traction.

Consumer Insight

- Channel Performance Trends: Share and frequency shifts in pubs compared with other eating out formats.

- Who is Coming Back: Demographic and regional patterns in consumer rediscovery and engagement.

- Occasion Mapping: Insights into how dayparts, missions and visit impulses are evolving in the pub context.

- Motivators and Decision Filters: What drives choice such as value, quality, convenience or brand integrity, and how that influences behaviour.

- Products and Preferences: Live menu choices, beverage preferences, health and wellness considerations and brand-led decision factors.

- Ranking by Occasion Engagement: Which operators lead in visit share and spend across various occasions and consumer cohorts.

Future Outlook

- Forecast to 2028: Projected market value, outlet dynamics and managed versus independent share expectations.

- Emerging Formats and Revenue Streams: Growth of hybrid, mission-led and accommodation-integrated models.

- Strategic Opportunity Areas: High value consumption segments, occasions and growth-worthy model adaptations.

- Innovation and Investment Trends: Future-focused functions such as dynamic pricing, leisure digitisation, lifestyle technologies and consumer lifestyle adaptation.

- Risk and Resilience Outlook: Key sectoral threats from macroeconomic fragility to competitive intensity, and strategic responses.

Methodology

This report is powered by Lumina Intelligence’s full suite of insight tools, including:

-

Eating & Drinking Out Panel

Tracking the behaviour of 1,500 nationally representative consumers each week, building up to a sample of

78,000 every year. This covers all eating out channels and day-parts (including snacking),

from 2020 to 2025. -

Operator Data Index

Continuous turnover and outlet data on 400+ UK pub, restaurant, QSR, sandwich and coffee shop operators.

-

External Data Sources

Lumina Intelligence also uses external sources, including desk research, the Office for National Statistics

(ONS), GfK Consumer Confidence Index, and EY ITEM Club economic indicators.