About the report

Future Food: How the UPF Debate is Reshaping Consumer Behaviour is a definitive, data-led exploration of how health, diet, and technology are transforming the global food landscape. Commissioned exclusively for Food Navigator, this report investigates the intersection of health, sustainability, and innovation, providing essential intelligence for brands navigating change.

Drawing on responses from more than 9,000 consumers across 13 countries (including the UK, USA, China, Japan, South Korea, France, Germany, Italy, Spain, Australia, India, Malaysia, and Singapore) this report delivers internationally representative insights into consumer perceptions, behaviours, and purchase drivers.

Key themes explored include evolving definitions of healthy eating, the accelerating backlash against ultra-processed foods, the role of functional ingredients, and the adoption of new food technologies. From health priorities and cultural norms to labelling transparency and consumer trust, this report uncovers the attitudes and trade-offs shaping the future of food.

Who is it for?

This report is crucial for food and beverage brands, ingredient suppliers, manufacturers, investors, and analysts aiming to understand the latest consumer trends in health, diet, and food technology. Whether you are an established brand, an emerging challenger, or a supplier looking to expand internationally, the report provides the insights needed to navigate shifting consumer perceptions, adapt strategies, and seize growth opportunities in a rapidly evolving marketplace.

Questions this report answers

- What are the top health priorities driving consumer choices worldwide, and how do they differ by region?

- How do cultural norms and traditions influence consumer perceptions of health and diet?

- What functional ingredients are consumers most interested in, and where are the biggest opportunities for growth?

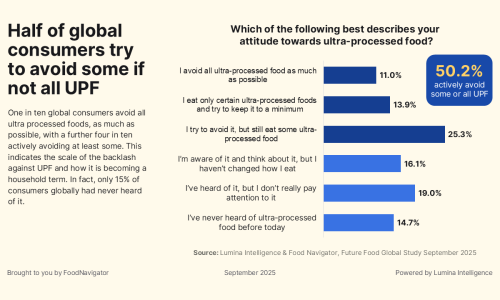

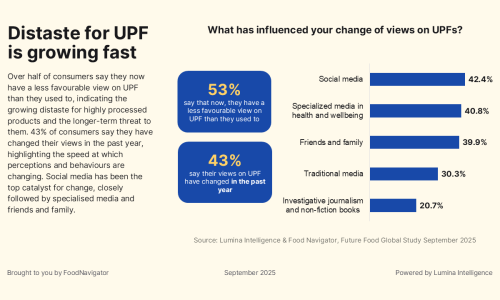

- How strong is the backlash against ultra-processed foods, and how are attitudes shifting across different demographics and markets?

- What trade-offs are consumers willing to make — such as higher prices, shorter shelf-life, or reduced convenience — to avoid UPFs?

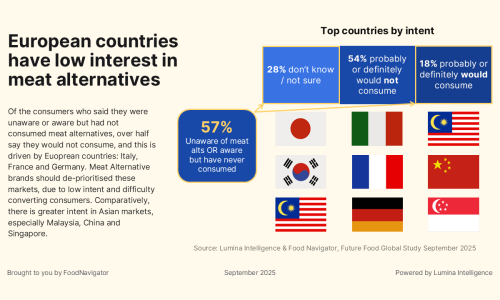

- How do consumers perceive and respond to new food technologies, from meat alternatives and mycoproteins to cell-cultivated meat and precision fermentation?

- What role do transparency, labelling, and education play in building trust and driving adoption of new food products?

- Which regions present the highest levels of openness to innovation, and which show the strongest resistance?

- How are health perceptions aligning or diverging from actual diets, and what messaging is required to bridge this gap?

- What commercial opportunities and risks do these shifting consumer attitudes create for brands, suppliers, and investors?

Australia

- Data on willingness to make product trade-offs to avoid UPFs.

- Data on protein consumption and demand for functional ingredients.

China

- Data on recent changes in perceptions of UPFs.

- Data on functional ingredient engagement.

- Data on awareness and intent for new food technologies.

France

- Data on UPF awareness and avoidance.

- Data on demand for natural versus added-benefit products.

Germany

- Data on GMO awareness and consumption intent.

- Data on acceptance of new food technologies.

India

- Data on UPF avoidance and willingness to pay more.

- Data on immunity as a health goal.

- Data on functional ingredient usage and openness to food technologies.

Italy

- Data on UPF avoidance.

- Data on fresh and natural food preferences.

- Data on demand for added-benefit products.

Japan

- Data on UPF awareness and avoidance.

- Data on self-perception of diet health.

- Data on awareness of food technologies.

Malaysia

- Data on consumer demand for transparency and labelling of new technologies.

- Data on functional ingredient engagement.

- Data on GMO and cell-cultivated meat intent.

Singapore

- Data on health goals (e.g., sleep).

- Data on transparency and labelling demand for new technologies.

- Data on intent to try cell-cultivated meat.

South Korea

- Data on self-perception of diet health.

- Data on immunity as a health goal.

- Data on willingness to try new technologies.

Spain

- Data on association of healthy diet with UPF avoidance.

- Data on gut health benefits.

- Data on meat alternative adoption.

United Kingdom

- Data on UPF awareness and avoidance.

- Data on protein consumption.

- Data on meat alternative consumption.

United States of America

- Data on protein consumption.

- Data on diet perceptions versus consumption.

- Data on openness to new food technologies.

Table of Contents

Executive Summary

- Key global findings

- Regional highlights and divergences

- Core implications for industry stakeholders

- Strategic opportunity themes

Dissecting Health Across the Globe

- Global Health Goals and Consumer Priorities

- Sleep as a Universal Health Objective

- Cultural and Societal Influences on Health Perceptions

- Functional Ingredients: Regional Uptake and Consumer Demand

- Divergence Between Perceived and Actual Health

- Protein, Gut Health and Immunity as Growth Drivers

UPF: Consumer Attitudes and Behaviour Change

- Scale of Awareness and Avoidance

- Regional Divides in Perceptions and Consumption

- Definitional Confusion and Consumer Interpretations

- Age and Demographic Influences on UPF Attitudes

- Trade-offs in Purchase Intent: Convenience, Price, Taste and Texture

- Willingness to Pay and Price Elasticity by Region

- Long-term Implications for Product Innovation and Marketing

New Foods and Technologies: Driving Adoption

- Consumer Awareness of Emerging Food Technologies

- Health and Functional Benefits as Adoption Levers

- Curiosity and Openness as Trial Motivators

- Education, Transparency and the Role of “Natural”

- Regional Divergences in Acceptance and Resistance

- Labelling, Trust and Communication Priorities

Meat Alternatives

- Awareness, Trial and Conversion Trends

- Market Leaders and Regional Performance

- Motivations: Curiosity, Animal Welfare and Environment

- Barriers: Naturalness and Knowledge Gaps

- Country-Level Opportunities and Challenges

Mycoproteins

- Awareness and Knowledge Gaps

- Regional Awareness Differences (China vs. Japan)

- Drivers of Consumption: Health, Ethics, Curiosity

- Barriers to Trial and Conversion Levers

GMOs (Genetically Modified Organisms)

- Global Awareness and Country Comparisons

- Willingness to Consume and Resistance Levels

- Drivers: Curiosity, Environmental Benefits, Health and Cost

- Barriers: Knowledge Deficits, Long-Term Health Concerns, Naturalness

Precision Fermentation

- Global and Regional Awareness

- Intent to Try and Key Opportunity Markets

- Motivators: Curiosity, Health, Taste and Science Trust

- Barriers: Education and Naturalness Perceptions

- Regional Variance in Objections and Engagement

Cell Cultivated Meat

- Awareness by Market, Regulatory Context and Early Approvals

- Consumer Reluctance and Acceptance Patterns

- Motivators: Curiosity, Animal Welfare, Climate Change and Safety

- Barriers: Knowledge Gaps, Naturalness and Trust Deficit

Global Health Goals and Consumer Lifestyles

- Ranking of Global Health Goals by Demographics

- Cultural Practices and Their Impact on Health Priorities

- Perceptions of Healthy Diets vs. Reality

- Consumption of Conventionally “Unhealthy” Categories

- Functional Ingredients: Vitamins, Minerals, Mushrooms and Adaptogens

- Regional Demand Hotspots and Market Opportunities

- Protein, Immunity and Gut Health as Priority Benefits

Strategic Implications for Industry

- Consumer Messaging: Positive Health vs. Restriction

- Targeting Generational Segments in UPF and Food Tech Adoption

- Pricing and Value Strategies in Western vs. Asian Markets

- Role of Policy, Education and Regulation in Shaping Behaviour

- Innovation Pathways in Non-UPF, Functional and Tech-Led Products

Future Outlook

- Forecast for Global Health and Nutrition Trends

- Evolution of Consumer Behaviour Around UPF and New Food Technologies

- Strategic Opportunities for Food and Beverage Companies

- Long-term Risks, Uncertainties and Scenarios

Methodology

This report is powered by Lumina Intelligence’s global quantitative online survey, commissioned exclusively for Food Navigator. Fieldwork was completed in July 2025, capturing the views of 9,500 consumers across 13 countries: Australia, China, France, Germany, India, Italy, Japan, Malaysia, Singapore, South Korea, Spain, the UK, and the USA. Each national sample is representative, with larger bases in China and the USA (2,000 respondents each) and 500 respondents in all other markets.

The study explored 20 carefully designed questions, covering:

- Attitudes towards and purchase behaviour around health

- Perceptions of ultra-processed foods and how these influence attitude and behaviour change

- Awareness, drivers, and barriers of new food and technologies, including meat alternatives, mycoproteins, precision fermentation, cell-cultivated meat, and GMOs

This robust methodology ensures the insights are both internationally comparable and locally relevant, providing a unique evidence base for understanding the evolving dynamics of health, processing, and innovation in the global food system.