The Lumina Intelligence Menu & Food Trends Report 2023 provides a comprehensive overview of menu engineering and pricing trends from across the chain restaurant and pub & bar sector. Understand how operators are adapting their menus in the face of headwinds, including price inflation, dish count and product labelling. Identify the mega trends impacting the UK hospitality sector and the opportunities and challenges that these present, including the attitudes and expectations of consumers.

Menu Composition & Engineering

Menu Tracker section sample and methodology

Menus reflect shift in both supply and demand

Pricing

Same-line dish inflation across chain and pb restaurants

Menu section sees notable price increases

Cuisine driving main price increases

Cuisine driving main dish price increases at pubs

How bar and pub operators are making food more expensive

Types of dishes driving up price points

New main dishes are more premium

Chain restaurant operators retaining entry level prices to remain affordable

Patterns in entry and exit price increases across courses in & bars

Left digit anchoring ion chain restaurant main dishes

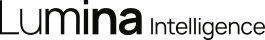

Dish count changes on menus post covid

Pubs and bars and main course options

Pubs rationalise meat-free starters and crowd favourites

Sizzling Pubs expands its range of specific starters

Meat-free starter options are growing across chain restaurant menus

Items & Trends Analysis

Meat-free main dishes are increasing share of menus

Item more than doubles its share of main dishes year-on-year

Operators are expanding the variety of dishes

Item growing share of main menus at pubs & bars

Pub & bar operators are increasingly offering customisable mains

Pub and Bar customisable main dish examples

Operators introduce more vegetables-based side dishes

Top vegetables used reflects the prevalence of 3 different dishes

3 items among top growing vegetables

Top growing adjectives on menus

Restaurant capitalising on growth of Korean cuisine

Operators hinting at alcohol pairings across menus

Pubs offering take-home sauces for purchase

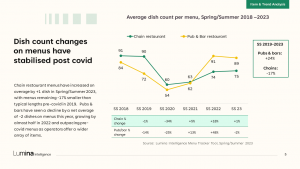

Chain restaurant and pub & bar operators offering wider range of dessert items

Branded dessert items have grown share of pub menus

Christmas menu trend spotting

Operators look to offer classics with a twist

Current ingredient trends offered across Christmas menus

Restaurant chain has focused on limited edition specials

Restaurant chain capitalising on trends for premium ingredients

Chain restaurant operators have introduced festive cocktails

Lifestyle & Mega Trends

Factors driving mega trends

Consumer spending forecast

Wage growth picking up

Consumer confidence and household spending power

8 mega trends impacting the food and beverages industry

Consumer centricity in a cost-conscious market

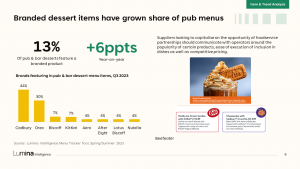

Operators are targeting value through range adjustments and rewards programmes

Consumer demand for functional beverages on the rise

Healthier eating becoming nuanced

The impact of calorie labelling on menus

Tiered customisation during the cost-of-living crisis

Personalisation growth in the coffee & sandwich channel

Digital menu personalisation and the consumer experience

Sustainability transparency for driving consumer engagement

Operators increasingly prioritise initiatives

Provenance and spend justification

Tech integration

Competitive leisure offerings

Increased customer selectivity

Tech innovation

Diversifying formats

Growing treat missions

Limited edition seasonal indulgences

Key Trends

Shifting lifestyles and finances

Key trend umbrella

Trend evolution curve

Lifestyle trends

New innovations in dairy

Nutrient dense products

Healthy frozen meals

Factors affecting late night trade

Value scrutiny and new dish creations

Budget friendly tinned meats

Experience trends

Automation technology and cost mitigation

The competitive socialising space

Party dining amid nightclub market

Social media and maximalist restaurants

Cuisine Trends

Cuisine trend hotspots

Afghan cuisine

Experience demand and authentic cuisines

Sustainability and British fusion

Demands for Portuguese cuisine

Korean cuisine

Product trends

Health and sustainability in insect protein

Sustainable consumption

Creative flavour combinations

Meat-free products

Social media and product trends

Consumers prioritising health

Factors driving drink trends

Mushroom tea

Ready to drink cocktails

Popular breweries shift focus

Health accessible drinks

Factors driving soft drink expansion

Future Outlook

Sustainability and digitalisation innovation

Economic indicators forecast for 2024

Market forecast for 2026F

Factors driving market recovery in 2024

Business leaders prioritisation

Sustainable solutions in 2024

Sustainability initiatives on menus

Collaboration and environmental consciousness

Factors influencing the need for digitalisation

AI and the future of foodservice

Use of artificial intelligence growing in the sector

Company set to launch artificial intelligence-powered ordering assistant

The power of artificial intelligence for restaurants

Lumina Intelligence forecasts key drivers for the evolution of its eight mega trends

Eating & Drinking Out Panel – Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and dayparts (including snacking) 2020-2023

Market Sizing & Operator Data Index – Market sizing data tracking the performance of hospitality and grocery operators, based on turnover and outlet numbers Extracts from Operator Data Index and wider synthesis with total Eating Out market sizing Lumina Intelligence Operator Data Index tracks and forecasts outlet and turnover information for over 400 brands across the eating out market 2017-2026F

Menu Tracker – Lumina Intelligence’s Menu Tracker tool tracking menu data from 80 operators across the Eating Out market Chain restaurant and Pub & bar menus analysed in the report Tool also covers QSR & Sandwich & bakery Spring/Summer 2022-2023

Secondary external sources – Lumina Intelligence also uses external sources including desk research, GFK Consumer Confidence Index and EY Item Club economic indicators