The eating out market is set to grow by +5% vs 2019, driven by continued recovery post covid and high inflation.

With the eating-out market facing a multitude of supply-side and demand challenges, the annually published UK Eating Out Report remains the trusted source of insight for leading manufacturers and operators in the UK.

This definitive report quantifies the size and growth of the channel and market forecasts out to 2026, with a detailed look at growth drivers and potential inhibitors.

Featuring detailed insights into the competitive landscape of the eating out market and comprehensive analysis of market and consumer trends impacting the industry, the Lumina Intelligence Eating Out Market Report 2023 is the reliable source of intelligence on this complex sector.

Executive summary

- Eating out market forecast

- New openings in 2023

- Delivering an experience

- Future market growth

Market insight

- Total eating out market forecast

- UK forecast 2023

- Consumer Confidence

- UK Eating Out Market Landscape 2023F

- Retail, Travel, & Leisure Landscape, 2023F

- Hotels, Pubs, & Restaurants Landscape, 2023F

- Contract Catering Landscape, 2023F

- Eating Out Market Growth

- Service-Led Restaurants Sizes

- Quick Service Channels

- Service-Led Restaurants Market Share

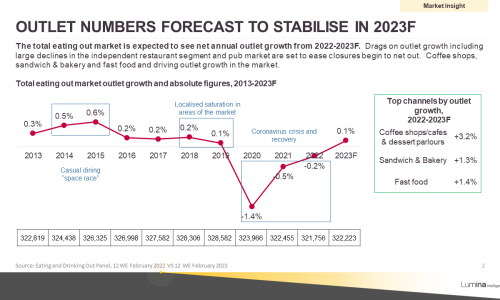

- Outlet Numbers Forecast

- Retail, Travel, & Leisure Growth Inhibitors, 2023F

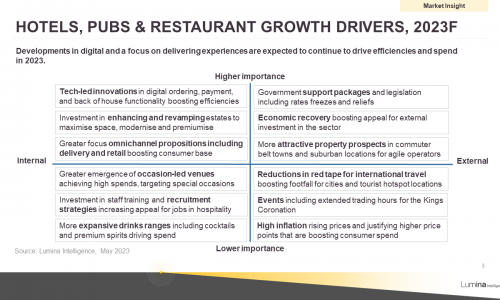

- Hotels, Pubs, & Restaurant Growth Drivers, 2023F

- Hotels, Pubs, & Restaurant Growth Inhibitors, 2023F

- Contract Catering Growth Drivers, 2023F

- Contract Catering Growth Inhibitors, 2023F

Competitive landscape

- Leading Brands Diversifying Propositions

- Leading Companies’ Growth

- Top Companies’ Turnover

- Leading Companies’ Outlet Share Growth VS 2022

- Leader of Branded Restaurant Outlet Share

- Nando’s Growth Through Innovation

- TGI Fridays Reconnects with Roots Through Cocktails

- QSR Brand Outlet Share

- Largest Pub and Bar Brands Outlet in 2023

- Top Pub and Bar Restaurant Brands are Value-Led

- Specialised Brands Lead Growth

- 4 Trends Driving Pub and Restaurant Growth

- Lead Hotel Brand 2023

- Brand Expanding Offering

- The Rise of Competitive Socialising Venues

- Leading Coffee Shop/Café Outlet Share

- Leader of Largest Brand by Outlets

- Demand for Omnichannel

- Gail’s Digital Innovations

- Gregg’s Focus on Accessibility

- Top Brands Focus on Diversifying Formats & Offerings

- Co-op leads net growth

- Lead of Outlet Count Year on Year

Consumer insight

- Penetration Uptick Signals Recovery

- Consumers Return to Out of Home Market

- Penetration Uptick Driven By Improved Confidence

- Value Scrutiny Increases in Importance

- Day-Time Occasions Post-Covid

- Consumers Increasingly Turning to Retail

- Consumers and QSR Lunch Occasions

- Focus on Value and Experiences

- Importance of Value Incentives

- 45-54’s At Risk

- Consumers over 45 Returning to Market

- ABC1 Consumers Market Share

- East England Growth in Share

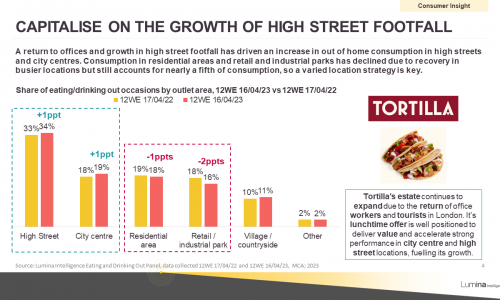

- Growth of High Street Footfall

- On The Go and Socialising VS Home Visits

- Choice and Proximity Driving Choice of Operator

- Opportunity to Improve Satisfaction

- Offering Experiences to Boost Venue Visits

- Food and Drink Pairings on Delivering Value

- Consumers and Savoury Food

- Non-Alcoholic Drinks Benefit From Innovation

- Beer Proportions in Alcoholic Drinks

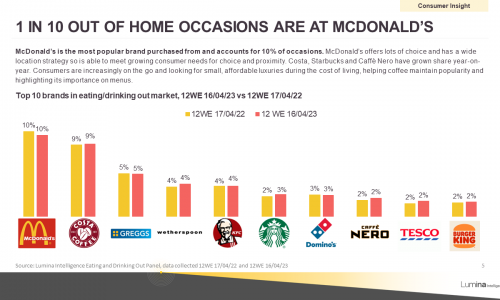

- Home Occasions at McDonalds

- Wetherspoon Share Year on Year

- Consumer Likelihood to Drink

- Opportunity to Include Low 2 Options

Future outlook

- Eating Out Market Growth

- UK Economic Indicators Stabilisation

- Eating Put Market Value in 2026F

- Outlet Growth Forecast, 2024F

- Market Growth Expectations Past 2023

- QSR Gains

- Delivery Share of Eating Out Market

- Quick Service Brands and Share Growth

- Size of Prize for Top 10 channels from 2023F-2026F

- Retail, Travel & Leisure Growth Inhibitors, 2023F-2026f

- Hotels, Pubs & Restaurant growth drivers, 2023F-2026f

- Hotels, Pubs & Restaurant growth Inhibitors, 2023F-2026f

- Contract Catering Growht Drivers, 2023F-2026F

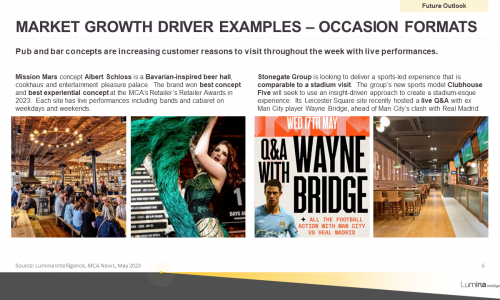

- Market Growth Driver Examples – Occasion Formats

- Market Growth Driver Examples – Technology</li

- Market Growth Driver Examples – Technology

- Market Growth Drivers – Sustainability

- 78,000 online surveys (1,500 per week) through Lumina Intelligence’s Eating & Drinking Out Panel to understand monthly consumer behaviour out of the home.

- Market sizing data tracking the performance of hospitality and grocery operators, based on turnover and outlet numbers.

- Operator performance for 700+ leading hospitality operators from Lumina Intelligence Operator Data Index.

Download the sample

| Section | Price | |

|---|---|---|

| Market Insight & Future Outlook | £ 1,500 | Order this section |

| Competitive Landscape | £ 1,500 | Order this section |

| Consumer Insight | £ 1,500 | Order this section |

| Full Report | £ 3,250 |