The Lumina Intelligence Menu & Food Trends Report 2025 is now published, delivering the most comprehensive view of how UK chain restaurants and pubs & bars have navigated menu strategy through a year defined by inflation, cost pressure and recalibrated consumer expectations.

The report explores how the triad of value, quality and health has become inseparable in consumer decision-making, why plant-based strategies are diverging between restaurants and pubs, and how global comfort food, digitalisation and guided personalisation are shaping the next phase of menu innovation.

Positioned as both a summary of the year just passed and a forward-looking guide to 2026 and beyond, the Menu & Food Trends Report 2025 equips operators, suppliers and investors with the insight needed to future-proof menu strategy in an increasingly complex trading environment

Who Is This Report For?

- Restaurant, pub and bar operators refining menu and pricing strategies

- Food and drink suppliers tracking operator demand and innovation direction

- Investors and advisors assessing structural shifts in eating out

- Foodservice marketers and product teams shaping future-facing propositions

Questions This Report Answers

- How are UK restaurants and pubs rethinking menu pricing as consumers approach price sensitivity limits?

- Where are operators increasing prices — and where are they using sides, bundles and add-ons to drive margin instead?

- How are value perceptions being reshaped by quality, health, freshness and provenance?

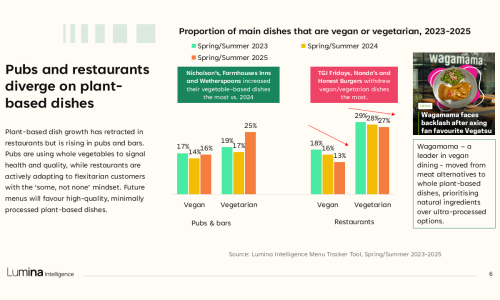

- Why are plant-based dishes declining in restaurants but growing in pubs and bars?

- How are global cuisines influencing familiar menu staples without alienating core customers?

- How widespread is guided personalisation, and how does it differ from traditional customisation?

- What role do digitalisation, automation and AI play in future menu and operational strategies?

- Which menu and lifestyle trends will define menu development into 2026 and beyond?

MARKET CONTEXT & MENU LANDSCAPE

- Economic & Cost Environment – Analysis of inflation, wage growth and operational cost pressures influencing menu pricing and engineering decisions.

- Graph: UK inflation vs menu price inflation, 2019–2025

- Consumer Value Reset – How value perceptions have evolved post cost-of-living crisis, with quality, health and provenance reframing willingness to pay.

- Graph: Consumer willingness to pay more for freshness, quality and seasonality

- Channel Divergence – Structural differences in how restaurants versus pubs & bars are responding to economic headwinds.

- Graph: Price inflation and affordability strategies by channel

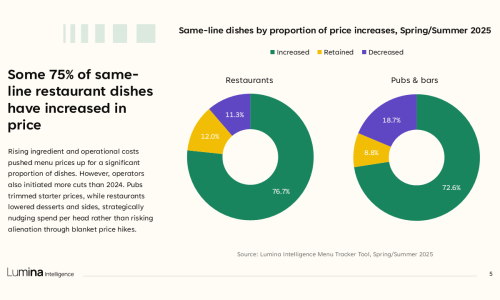

MENU PRICING & ENGINEERING

- Deep-dive analysis of how operators are reshaping pricing architecture to protect margins without eroding demand.

- Same-Line Price Inflation – Tracking price increases across mains, starters, sides and desserts.

- Graph: Proportion of same-line dishes with price increases, Spring/Summer 2025

- Strategic Price Cuts & Affordability Signals – Where operators are lowering prices to nudge spend per head and protect entry points.

- Graph: Price cuts by dish category – restaurants vs pubs

- Entry, Average & Exit Prices – How menus are widening price ladders to balance accessibility and premiumisation.

- Graph: Entry, average and exit prices across channels

- Psychological Pricing & Endings – The use of price endings (£#.99 vs £#.00) to manage value perception.

- Graph: Distribution of price endings across menus

MENU COMPOSITION & ITEM TRENDS

- What’s changing on menus – and why – across proteins, formats and descriptors.

- Plant-Based & Vegetarian Evolution – Diverging strategies between restaurants and pubs, and the shift away from ultra-processed alternatives.

- Graph: Proportion of vegan and vegetarian mains, 2023–2025

- Protein & Ingredient Mix – Changes in protein usage, vegetable-forward dishes and ingredient signalling.

- Graph: Mains by protein type, 2023–2025

- Menu Language & Claims – Fastest-growing descriptors reflecting quality, freshness and indulgence.

- Graph: Top five growing menu adjectives by share growth

- Menu Size & Range Management – Average dish counts and the balance between expansion and simplification.

- Graph: Average number of dishes per menu

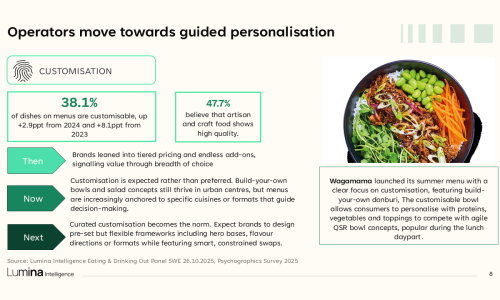

CUSTOMISATION & MENU SIMPLIFICATION

- How operators are moving from endless choice to guided personalisation.

- Customisation Adoption – The rise of configurable dishes across UK menus.

- Graph: Proportion of customisable dishes, 2023–2025

- From ‘Then’ to ‘Next’ – Evolution from add-ons to curated frameworks built around hero bases and flavour directions.

- Case Study: Wagamama’s modular bowl and customisation strategy

- Operational Benefits – Why guided personalisation supports both consumer choice and kitchen efficiency.

LIFESTYLE & MEGA TRENDS

- The eight macro trends reshaping food, drink and menu innovation.

- The Eight Mega Trends – Digital, health, value, provenance, indulgence, convenience, experience and freshness.

- Graph: The eight mega trends impacting the F&B industry

- Mindful Indulgence – How indulgence is shifting towards drink-led, experiential and visually driven formats.

- Graph: Growth in indulgent drink-led menu items

- Provenance & Trust – Why freshness and sourcing are now core quality cues.

- Graph: Freshness as the top indicator of quality

DIGITAL, CREATORS & EXPERIENCE

- From online discovery to real-world menu innovation.

- Digital Discovery to Physical Activation – How social media shapes menu trends and consumer expectations.

- Case Study: Creator-curated festive market

- Brand & Creator Collaborations – Leveraging partnerships to drive engagement and differentiation.

- Case Study: Topjaw x 40ft Brewery limited-edition IPA

- Technology-Enabled Experience – The role of digital touchpoints in reducing friction while enabling exploration.

FUTURE OUTLOOK & STRATEGIC IMPLICATIONS

- What menu strategy looks like as operators plan for 2026 and beyond.

- Market Drivers to 2028 – Economic, behavioural and operational forces shaping future menus.

- Graph: Key economic indicators and forecasts

- Menu Strategy Predictions – How pricing, composition and customisation will evolve.

- Chart: Menu trend development outlook

- Business Agendas for the Next 12 Months – Where operators are focusing investment and innovation.

- Graph: Operator priorities and strategic focus areas

This report is powered by Lumina Intelligence’s proprietary datasets and external economic sources, combining menu tracking with consumer behaviour insight to quantify what’s changing on UK chain restaurant and pub & bar menus.

- Menu Tracker Tool: Menu data captured across 80 operators in the eating-out market, with chain restaurant and pub & bar menus analysed for Spring/Summer 2022–2025 (tool also covers QSR and sandwich & bakery).

- Eating & Drinking Out Panel: Weekly behavioural tracking of 1,500 nationally representative consumers, building to ~78,000 respondents per year, covering channels and dayparts (including snacking), 2020–2025.

- Secondary external sources: Desk research and key indicators including GfK Consumer Confidence and EY ITEM Club economic indicators to contextualise trading conditions.

- Reporting framework: Analysis focuses on menu pricing and engineering, item and trend shifts, and lifestyle/mega trends, with forward-looking implications for operators and suppliers.