In 2021, Lumina Intelligence predicted that the widespread impact of staffing shortages and heightened costs would impact pubs & bars channel as well as identifying opportunities in alternative dayparts and local sourcing. With rising inflation and the cost of living crisis, we will take a deep dive into how the channel is performing this year and how it will fare for 2023.

The Lumina Intelligence Pubs & Bars Market Report 2022 is a must-have review of the UK pub & bars market. Including market sizing and forecasts to 2025, up to date consumer behaviour insight and analysis of the current pub & bars competitive landscape, this report is a holistic source of intelligence on this channel for suppliers, operators, service providers and investors alike.

Our unique comprehensive report helps our clients understand the scope of the pubs & bars channel highlighting areas of opportunities as well as future potential inhibitors to growth providing invaluable data & insight to commercial, category and insight teams.

- FIFA World Cup

- EY Item Club

- BBPA

- Mitchells & Butlers

- Fuller’s

- Marston’s

- J D Wetherspoons

- Young’s

- Stonegate

- Greene King

- Nightcap

- Butcombe Brewery

- New World Trading Company

- The Botanist

- Red Oak Taverns

- Hall & Woodhouse

- Valiant Pub Company

- SA Brain

- Fortress Investment Group

- Punch Pubs & Co

- Hippo Inns

- Alchemy Partners

- Brasserie Bar Co.

- Lucky Onion Group

- Portobello Starboard

- The City Pub Group

- SA Brain

- Song Capital

- Shepherd Neame

- Goldman Sachs

- Loungers

- Whitbread

- Hawthorn Leisure

- Harvester

- Two for One

- Star Pubs & Bars

- Chapter Collection

- Clerk & Well

- Liberation Group

- Punch Pubs

- BrewDog

- JJ Goodman

- Arkell’s Brewery

- Brunning & Price

- Felinfoel Brewery

- Revolution Bars Group Plc

- Heavitree Brewery

- Laine Pub Company

- Butcombe Brewery

- Inglenook Taverns

- Palmers Brewery

- Gray & Sons

- The Cocktail Club

- The Botanist

- Urban Pubs & Bars

- Barworks

- New World Trading Company

- Tropicana Beach Club

- Urban Pubs

- Barrio Familia

- Goram IPA Zero

- Sizzling Pubs

- Vintage Inns

- Beefeater

- Brewers Fayre

- Ember Inns

- Toby Carvery

- Chef & Brewer

- Stonehouse Pizza & Carvery

- Slug & Lettuce

- BrewDog

- Nicholson’s

- Farmhouse Inns

- Flaming Grill

- Table Table

- All Bar One

- Old English Inns

- NQ64

- Vagabond

- The Baring

- San Miguel

- Carling

- Hungry Horse

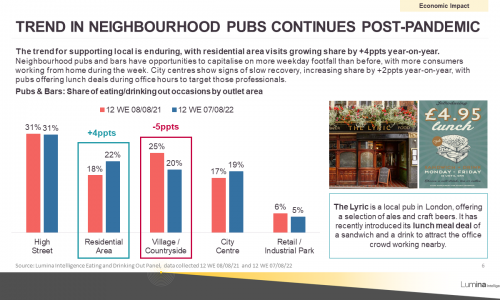

- The Lyric

- Budweiser

- Carlsberg

- Fosters

- Stella Artois

- Amstel

- Corona

- John Smith

- Gordon’s

- Smirnoff

- Captain

- Morgan

- Malibu

- Jack Daniel’s

- Johnnie Walker

- Bacardi

- Grey Goose

- Jägermeister

- Dirty Martini

- O’Neill’s

- The Chocolate Cocktail Club

- Debauvoir Arms

- Provenance Inns & Hotels

- Albion & East

- Gravity Active Entertainment

- Roxy Leisure

Market Section

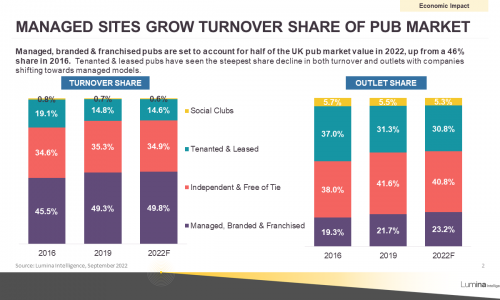

- Overview of the UK Pubs & Bars market by outlets and turnover, with growth from 2017-2022F

- Breakdown of the market by sub-channel, including managed, tenanted, and independent pubs with growth from 2017-2022F

- Benefits and challenges of different pub models Key market drivers and inhibitors in 2022F Key factors

impacting the pub market including cost of living crisis

- Wider information sourced from ONS around alcohol consumption rates and on-trade vs off-trade beer sales

- Wider economic and consumer spending information

Competitive Landscape Section

- Leading pub group developments including M&A activity, 2021-2022

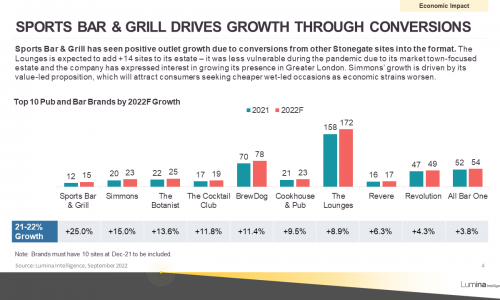

- Key trends and initiatives among pub groups and brands Leading pub groups by turnover Leading pub groups by outlets

- Top 10 smaller pub groups by outlets

- Top 20 pub brands by outlets

- Pub brand market positioning and business model analysis

Consumer Insight Section

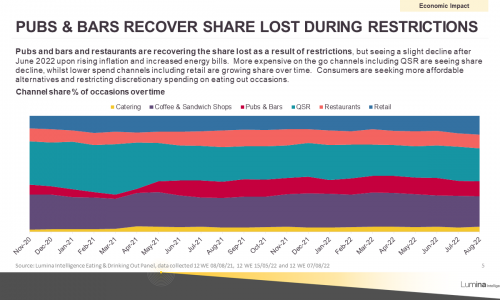

- Overall EDOP barometers including frequency, penetration, average spend Pub channel share of day-parts

- Demographic profile of pub visitors

- Key missions and needs in pubs and growth drivers

- Deep dive into drinks-only occasions in pubs including drivers to venue, drink type consumed, average spend

- Leading food choices at pubs

Product & Price Section

- February 2022 to July 2022 pub menu data using our brand new menu tracker tool

- New product development analysis

- Pub menu price analysis

- Deep dive on pub drink menus

Future Outlook Section

- Future market growth figures from 2022F-2025F

- Wider economic barometers including GDP forecasts

- Recovery growth drivers and inhibitors

- Growing pub models

- Emerging opportunities including outdoor areas, sports, third workplaces, sustainability, delivery

78,000 online surveys (1,500 per week) through Lumina Intelliegence’s Eating & Drinking Out Panel to understand monthly consumer behaviour out of the home.

Menu insight from Lumina Intelligence Menu Tracker – a monthly database of the menus and all their menu items across Top 80 operators across eating & drinking out brands in QSR, Restaurants, Pubs & bars and Coffee & Sandwich shops.

Operator performance for 700+ leading hospitality operators from Lumina Intelligence Operator Data Index.