The Lumina Intelligence UK Restaurant Market Report 2023 is a necessity for those looking to navigate the 2024 landscape. It includes market sizing and forecasts to 2026, up to date consumer behaviour insight and analysis of the current restaurant competitive landscape providing a holistic source of intelligence on this channel for suppliers, operators, service providers and investors alike. Our unique comprehensive report helps our clients understand the scope of the restaurant channel and how best to navigate the forth coming opportunities and challenges in the market. It is a must-have for any who operate in or supply the restaurant channel.

Market Insight

- UK Restaurant Market and inflation

- Consumer spending forecast

- Consumer confidence

- Total eating out market landscape 2023F

- UK restaurant market 2019 vs 2023F

- Total restaurant market landscape 2023F

- Branded restaurants

- Outlet decline and expectations

- Restaurant, fast food, and pub market comparisons

- Average weekly sales growth

- Service-led restaurant market growth drivers, 2023F

- Service-led restaurant market growth inhibitors, 2023F

- Trading conditions for operators

- Food costs and business challenges

Competitive landscape

- Top 10 branded restaurants by outlets

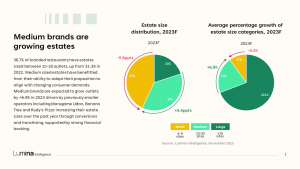

- Medium brands are growing estates

- Branded restaurants return to profitability

- Top 10 brands by operating margin

- Top 10 brands by average weekly sales per store

- Branded restaurant growth drivers

- Strategic acquisitions – group portfolios and debt alleviation

- Digital transformation strategies

- Targeted digital marketing campaigns

- Restaurant groups driving growth through value-led innovation

- Data-driven loyalty platforms

- Branded restaurants are diversifying

- Top 10 brands by outlet growth

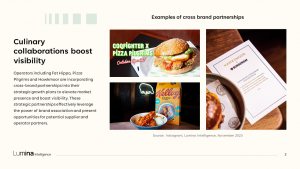

- Culinary collaborations boost visibility

- Top 10 brands by turnover growth

- Asian brands are expected to lead growth

- Chicken cuisine share takes flight

- Restaurants increasingly prioritise sustainability initiatives

- Kima – London

- CHŪŌ – London

- FOWL – London

- Wagamama Noodle Lab

Consumer Insights

- Demand for value halts restaurant recovery

- Consumers and dining out frequency

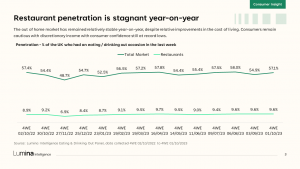

- Restaurant penetration year-on-year

- Branded restaurants drive uptick in penetration

- Consumers and value consciousness

- Cost of living crisis and the importance of value

- 18-34s share in value needs

- Opportunity to re-engage younger consumers

- Seasonal and sporting events

- Share of regions post-covid

- Restaurant share gain year-on-year

- Day-part share post-covid

- Social occasions

- Varied location strategy

- Consumer relationship with delivery

- Consumers and food and drink

- Bundle deals target value needs

- Non-alcoholic drinks shares year-on-year

- Pint prices and demand for beer

- Consumers and beer, wine, spirit purchasing

- Drink only occasions

- New cocktails

- Sustainability and drive spend

- Sustainability on menus

- Burger and chips, wedges and fries

- Brand leader

Product and Price

-

- Methodology and definitions

- Shifts in supply and demand

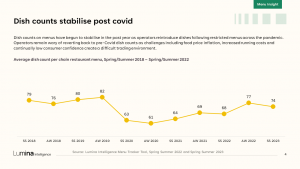

- Dish counts post-covid

- Main dishes focus

- Dish prices

- Average starter prices and inflation

- Rise in main dish prices

- Dessert prices

- Bill’s celebration desserts

- Prezzo premium dishes

- Pizza and chicken in restaurants

- Low calorie starts and side dishes

- Vegetable-based side dishes

- Plant based dishes on menus

- Pork dishes on menus

- Diversity of pork dishes

- New dishes and higher spends

- Focus on kitchen tourism

- Mainstream Italian brands and premiumisation

- Customisable dishes and spend in restaurants

- Bird flu and free-range dishes

- Growth in non-alcoholic drink counts

- Soft drink innovation

- Mixer lemonade reimagined in 2023

- Rising alcohol pricing

- Red and Rose wines price growth

Future Outlook

-

-

- Restaurants and eating out market pressures

- Average earnings forecast from 2025

- Restaurant market forecast for 2026F

- Outlet decline expectations

- Premium brands and their share growth forecast

- Restaurant, fast food, and pub market comparisons

- Service-led market growth drivers, 2023F -2026F

- Service-led restaurant market growth inhibitors, 2023F – 2026F

- Finance driven trends

- Businesses and prioritising new initiatives in 2023

- Restaurant market future trends

- The power of artificial intelligence

- Suppliers heavy lifting and staffing challenges

- Re-purposed spaces

-

Eating and Drinking Out Panel

Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and day-parts (including snacking)

2020-2023

Market Sizing and Operator Data Index

Market sizing data tracking the performance of hospitality and grocery operators, based on turnover and outlet numbers

Extracts from Operator Data Index and wider synthesis with total Eating Out market sizing

Lumina Intelligence Operator Data Index tracks and forecasts outlet and turnover information for over 400 brands across the eating out market

2017-2026F

Menu Tracker

Lumina Intelligence’s Menu Tracker tool tracking menu data from 80 operators across the Eating Out market

Branded restaurant operator menus analysed in the report

Spring/Summer 2022-2023

Secondary external sources

Lumina Intelligence also uses external sources including desk research, GFK Consumer Confidence Index and EY Item Club economic indicators