Overview

The Lumina Intelligence UK Convenience & Wholesale Market Report 2025 is the essential source of insight for retailers, wholesalers, suppliers, and manufacturers operating in the UK convenience and wholesale landscape. This definitive report provides market sizing and forecasts to 2028, evaluates key commercial trends, and delivers shopper and retailer insight across core missions, fascias, and categories.

Backed by Lumina’s robust data sets—including the Convenience Tracking Programme, Retailer Attitudes & Behaviours Study, and Market Sizing & Operator Index—the report presents the most comprehensive and strategic view of the sector available today.

Whether you’re exploring expansion opportunities, refining your symbol offer, investing in new formats, or aligning product strategy to mission-led behaviour, this report gives you the evidence and clarity needed to drive growth in an increasingly competitive and dynamic market.

About the Report

The UK Convenience & Wholesale Market Report 2025 brings together proprietary data across retailer and shopper touchpoints to build a complete view of the convenience and wholesale ecosystem. Quantifying a market worth £48.8bn in 2025, the report identifies which channels are set to win, which fascias are growing, and how economic and shopper pressures are shaping the landscape.

Key commercial and consumer themes such as inflation, loyalty, food-to-go, technology, price-matching, and health are examined in depth, with actionable recommendations throughout.

How to Use It

This report acts as a strategic decision-making tool across the convenience and wholesale value chain. Use it to:

- Benchmark fascia performance and market value across multiple segments.

- Understand the shopper missions that are driving footfall, frequency, and basket value.

- Optimise brand positioning, promotions, and NPD strategy based on consumer expectations.

- Anticipate future opportunities and mitigate risks through economic, political, and behavioural forecasting.

- Plan investments in fascia, store format, technology, categories and services with confidence.

Who Is It For?

The report is designed for professionals operating in, supplying to, or analysing the UK convenience and wholesale market, including:

- Symbol groups and fascia operators

- Retailers (managed and independent)

- Wholesalers and cash & carries

- FMCG manufacturers and distributors

- Investors and analysts tracking food and retail trends

Whether you’re an established brand or looking to break into the channel, this report gives you the edge in a fast-moving, mission-led environment.

Questions This Report Answers

Market Insight

- What is the current and forecasted size of the UK convenience & wholesale market?

- How are inflation, shopper spending, and economic pressures shaping performance?

- What are the major channel shifts, and which segments are best positioned for growth?

- How are pricing, loyalty, and promotions evolving in the channel?

Competitive Landscape

- Which symbol groups and fascia are leading estate growth in 2025?

- How are multiple retailers like Morrisons, Tesco, and ASDA adapting to convenience?

- What role are tech, value-led strategies, and store design playing in competitive positioning?

- Which operators are innovating through service, partnerships, and store formats?

Consumer Insight

- What are the most common missions in convenience, and how are they changing?

- How are shopper needs around health, premiumisation, and price influencing purchasing?

- How are different demographics engaging with convenience formats?

- What role does loyalty play in attracting and retaining shoppers?

Retailer Insight

- How are rising labour and energy costs affecting independent retailers?

- What investments are symbols making in delivery, digital, and sustainability?

- How are attitudes towards tech, refits, and value propositions shifting?

- What support are retailers seeking from suppliers and wholesalers?

Future Outlook

- How will the market grow to 2028 and what factors will influence performance?

- What are the biggest threats and opportunities retailers need to plan for?

- How will categories such as food to go, soft drinks, and own-label evolve?

- What is the future role of convenience in the wider UK retail and grocery ecosystem?

Executive Summary

Market Context

- Economic pressures and inflation outlook

- Graph: Key economic indicators, EY Item Club, 2019–2025F

- Graph: GFK consumer confidence, May 2019–May 2025

- Graph: Transport usage – percentage versus pre-COVID usage

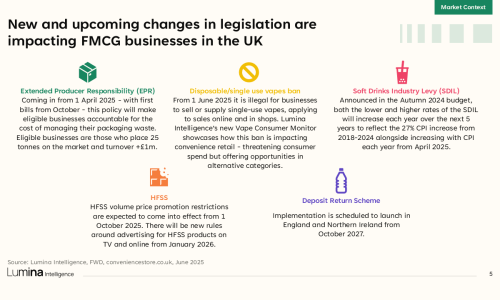

- Regulatory developments impacting the sector

- Macro trends influencing channel dynamics

- Graph: Macro/consumer trends impacting convenience retail

- Shopper confidence and changing spending behaviours

Convenience Market Performance

- Market structure and segmentation overview

- Graph: UK convenience market value in millions, with percentage growth, 2020–2025F

- Value and volume performance by channel

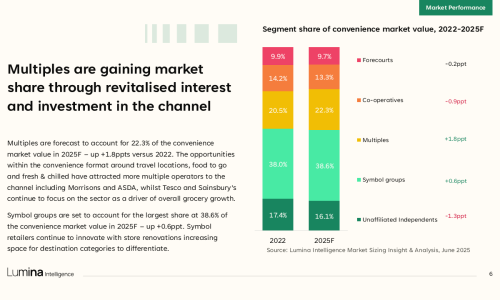

- Graph: Segment share of convenience market value, 2022–2025F

- Graph: Turnover growth by segment, 2020–2025F

- Channel-specific pressures and growth drivers

- Projected market outlook through to 2028

Convenience Competitor Landscape

- Overview of competitive pressures and format innovation

- Performance and strategy of key fascia and operators

- Graph: Top 10 Convenience Fascias by Outlets, Dec-24 to Dec-25F

- Trends in estate growth, pricing, and loyalty schemes

- Format evolution, destination-led services and digitalisation

Convenience Shopper Overview: Demographics and Clusters

- Shopper demographic profiling by age, income and region

- Graph: Penetration – % of consumers who have had a convenience occasion in the past 7 days

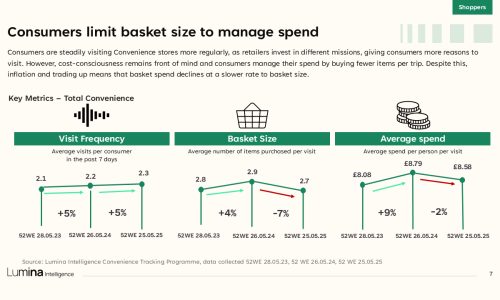

- Graph: Key Metrics – Total Convenience

- Mission frequency and occasion type by consumer group

- Graph: Top 10 Missions by share of occasions

- Overview of key shopper clusters

- Graph: Convenience vs Total UK Population – Age

- Graph: Missions by Age – PPT Change

- Graph: Missions by Age – Year-on-Year PPT Change

- Graph: Psychographics by Age – PPT Change

- Attitudinal and behavioural profiles linked to missions

- Graph: Top ranked drivers to store by age

- Graph: Top growing drivers to store by age

Convenience Shopper Trends and Opportunities

- Shopper expectations around value, quality and speed

- Graph: Clusters – Convenience share of trips %

- Key missions: top-up, food-to-go, treat and distress

- Graph: Drivers to store

- Graph: Purchase consideration factors

- Role of promotions, own-label, and loyalty in driving choice

- Impulse-led behaviours and premiumisation opportunities

Wholesale Retailer Behaviours & Attitudes

- Independent retailer sentiment and business outlook

- Graph: What are your biggest business concerns? – Top 10

- Operational challenges and investment priorities

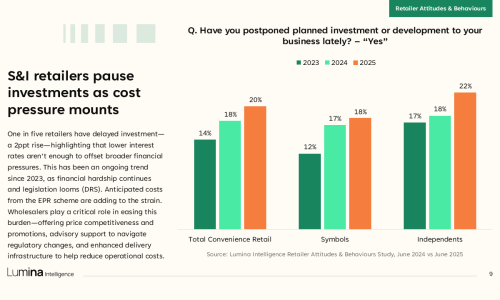

- Graph: Have you postponed planned investment or development to your business lately? – “Yes”

- Graph: What type of investment have you delayed?

- Graph: What are the current challenges to your store’s profitability?

- Graph: What type of investment have you implemented in the last 12 months?

- Retailer views on symbol groups and wholesale support

- Graph: What measures have you implemented to mitigate the impact of increasing living costs on your business? – Top 5

- Graph: Have you implemented any of these actions that contributed to your store’s profitability? – Top 5

- Graph: % of retailers that have frustrations when shopping in a depot or online

- Adoption of digital tools, fulfilment and app-based ordering

- Graph: How did you buy from wholesaler?

- Graph: In the last 12 months, have you changed the way you purchase stock?

- Graph: Which one best describes the reason for your last shop?

- Graph: When ordering stock online, how do you typically search for the products you want to purchase?

- Graph: Are there any categories that you specifically like buying price-marked packs for? – Top 10

- Graph: What categories generate the most of your store’s footfall? – Top 10

- Graph: What categories generate the most of your store’s profit? – Top 10

- Graph: When disposable vapes are banned from 1st June, what types of products, if any, do you plan to buy more of to replace them?

- Graph: How do you usually learn about new products?

Future Outlook

- Market growth projections to 2028

- Graph: Key economic indicators, EY Item Club, 2023–2028F

- Graph: UK convenience market value in millions, with percentage growth, 2023–2028F

- Expected shifts in shopper behaviour and trip missions

- Emerging opportunities by category and format

- Strategic priorities and risks shaping the next phase of growth

Methodology

Lumina Intelligence’s Convenience Tracking Programme tracks over 70,000 convenience shopping occasions annually, capturing mission behaviour, spend, frequency, category drivers, and demographic detail.

The Retailer Attitudes & Behaviours Study draws on 400 telephone interviews with symbol and independent retailers across the UK, providing unparalleled understanding of operator sentiment, investment patterns, and operational realities.

The Market Sizing & Operator Data Index covers turnover and outlet counts across key fascias, quantifying the size, share, and forecasted growth of the UK convenience and wholesale channel to 2028.

Secondary data sources include ONS, The Grocer, EY Item Club, Convenience Store, and GfK, providing macroeconomic an competitive context.