The report covers:

- Convenience market context & performance – Including key economic and shopper barometers, details on upcoming legislation and the size of the UK convenience market by turnover and outlets

- Convenience competitive landscape – The leading fascias in the convenience market by outlets as well as best in class retailer examples from across the market

- Convenience shopper overview & demographics – A summary of the key findings from the Convenience Tracking Programme, tracking the behaviours and attitudes of 50,000 UK shoppers, this section explores how shoppers are changing behaviours in convenience as a result of wider market context

- Convenience shopper demographic deep dive – This section explores the key differences in how different demographics use convenience and how this is changing. Key themes are the importance of food to go for younger shoppers and the prevalence of chilled foods as a driver for all.

- Wholesale market landscape and retailer behaviours & attitudes – This section features a summary of the leading wholesalers in the UK market by turnover and key opportunities/inhibitors in the wholesale market. This section also covers the findings from Lumina Intelligence’s bespoke research with over 400 retailers, investigating their attitudes and behaviours about and within the wholesale channel.

- Future outlook – Convenience market forecasts up to 2026F including market drivers and inhibitors

Market Context

- Recession and inflation

- UK Recession Forecast 2023

- Consumer Confidence

- Divergence Between Inflation and Wage Growth

- Key Metrics Impacting Shoppers

- Rail Strikes and Footfall Recovery

- Cost of Doing Business

- Mega Trends Impacting the Sector

Convenience Market Performance

- Inflation Driving Growth in Convenience

- Convenience Market Segment Definitions

- Inflation and Market Growth in 2022

- Convenience Forecast, 2023F

- Convenience Market Growth Drivers, 2023F

- Convenience Market Growth Inhibitors, 2023F

- Convenience Multiples Driving Growth, 2023F

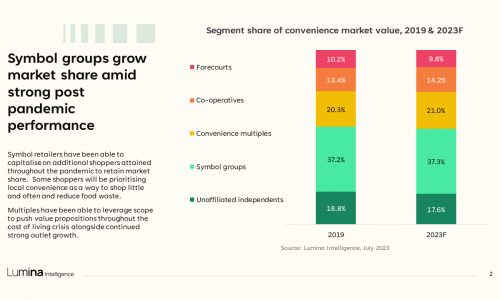

- Symbol Groups Grow Market Share

- Heightened Inflation Fuels Growth

Convenience Competitor Landscape

- Retailers Innovate to Differentiate Convenience

- Leading Largest Retailer

- Top 10 Fascia Profiles by Outlets

- Leading Symbol Group

- Four out of Five Convenience Multiples See Growth

- Company Expected to See Growth

- Retailers Diversifying Formats to Differentiate

- Food to Go Innovation Example

- Technology and Digitalisation Innovation Examples

- Delivery Innovation Examples

- Sustainability as a Driver of Innovation

Convenience Shopper Overview and Demographics

- Demand for Food To Go

- Record Flood Inflation

- Remaining Convenience Shoppers

- Average Spend Growth

- Examples of Expanded Ranges Driving Basket Increases on Key Categories

- Value Scrutiny

- Young Shoppers Seeking Value and Experience

- Key Convenience Missions for 2023

- Growth Drivers in Planned Top Up and Food To Go

- Oldham Forecourt and Social Media Presence

- Retailers Premiumise Dessert Offerings

- Snacking Gains Dominance

- MrBeast Feastables: The next ‘Prime’

- Opportunity to Target To-Go Occasions

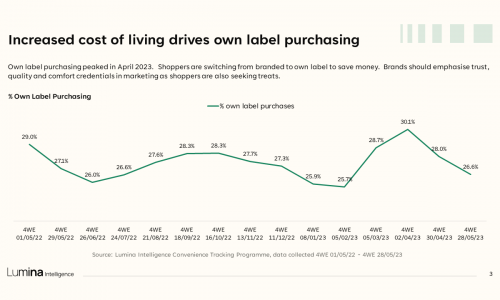

- Increased Cost of Living and Own Label Purchasing

- Household Staples VS Own Label Purchases

- How Brands Compete with Own Label

- Drivers for Convenience Store Visits

- Innovative Soft Drink Solutions

- Symbols & Independents vs Managed in Chilled Categories

- Families and Promotions

- Different Mechanisms Required to Drive Impulse Purchasing

- Warm Weather and Impulse Purchasing

- Non-smokers Grow as More Quit

- Category Reducing Alcohol and Smoking Consumption

- Packet Sizes for Vegetarian and Vegan Products

Convenience Shopper Demographic Deep Dive

- Age Group Difference Highlight Future for Convenience

- What Convenience Shoppers Look Like

- Younger Families’ Share in Convenience

- Category as Key Focus to Maintain

- Younger Families’ Share in Symbols and Independents

- Symbols and Independents Use

- Convenience’s Role for Different Age Groups

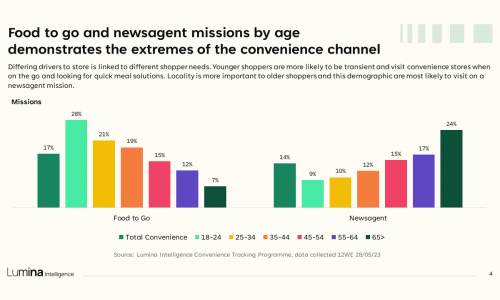

- Food To Go and Newsagent Missions by Age

- Major Footfall Driver Across All Age Groups

- Impacts on Younger Shoppers

- Experience vs Sustainability

- Supplier Activation Focus on Sustainability

- Convenience Retailers’ Initiatives

- Important Hours for Younger Shoppers

- Older Shoppers Inclination to Impulsive Shopping

- What 18-34 Buy on Impulse and Why

- Younger Shoppers Deal Hunting

Wholesale Market Landscape and Retailer Attitudes & Behaviours in Wholesale

- Increasing Cost of Doing Business

- Wholesale Market: Operator Opportunities

- Wholesale Market: Operator Challenges

- Leading Wholesaler’s Financials 2019-2023F

- Leading Wholesaler Value by Sub-Category

- Wholesale Profiles – Unitas

- Wholesale Profiles – Booker

- Wholesale Profiles – Costco

- Wholesale Profiles – SPAR

- Wholesale Profiles – Bestway

- Wholesale Profiles – CoOp/Nisa

- Wholesale Profiles – Brakes

- Wholesale Profiles – Bidfood

- Methodology & Objectives

- Energy Costs and Inflation

- Major Business Concern in 2023

- Plans to Support Wholesale

- Retailers Increasing Prices

- Suppliers and Wholesalers Support Retailers

- Rising Costs and Promotions

- Delivery Usage Post-Pandemic

- Buying on Promotion YOY

- Customer Demand and Promotions

- Bestway Tailored Promotions

- Shopping Through Digital Platforms

- Digital Platforms and Customer Experience

- Depot Shopping

- Digitalisation of Shopper Journey

- Ease and Speed on Online Platforms

- Search Function Refinements

- Value of Own-Label

- Soft Drinks Contribution to Sales

- Key Driver of Store Footfall

- Tobacco Products Sales for Symbols

- Key Profit Generator for Symbols

- What Do Retailers Think?

- Preferred Category in PMPs

- Favourite PMP Categories Reveal Opportunities

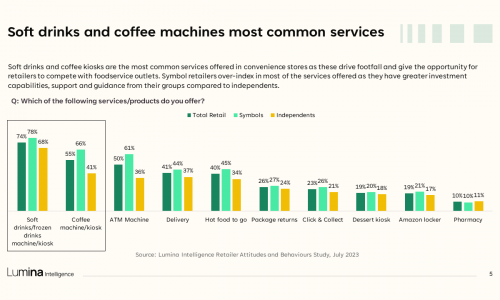

- Soft Drinks and Coffee Machines

- Top Priority for Independents

- Symbols and Investing

- Refurbishment of Stores Delayed

- Retailers Priorities

- Symbols and their Profit Margins

- Positive Sentiment in Future Expectations for Profit

Future Outlook

- Convenience Value Forecast 2026F

- UK Economic Indicators in 2024

- Convenience Value Forecast in 2026F

- Convenience Market Growth Drivers, 2023F-2026F

- Convenience Market Growth Inhibitors, 2023F-2026F

- Key Convenience Market Developments 2023F-2026F

- The Future: Differentiated Destination Categories

- The Future: Legislation

- The Future: Technology & Digitalisation

- The Future: Wellbeing of Convenience Retailers

Convenience Tracking Programme

Lumina Intelligence’s UK Convenience Tracking Programme (CTP) – Interviews with shoppers & non-shoppers at an annual sample size of 40,000+ weekly data collection in all major UK convenience groups. Continuous data captured online and in-store. (2020-present)

Market Size & Grocery Data Index

Market sizing data tracking the performance of hospitality and grocery operators, based on published and estimated turnover and outlet numbers. (2018-2026F)

Lumina Intelligence Bespoke Wholesale Questionnaire

Lumina Intelligence undertook a bespoke survey via telephone interviews with over 400 retailers, investigating their attitudes and behaviours about and within the wholesale channel. (May 2023)

Secondary External Sources

Lumina Intelligence also uses external sources including desk research, GFK Consumer Confidence Index and EY Item Club economic indicators.

Download the sample

| Section | Price | |

|---|---|---|

| Convenience Market Performance, Competitor Landscape | £ 1,500 | Order this section |

| Convenience Shopper Overviews & Demographics | £ 1,500 | Order this section |

| Wholesale Market Landscape & retailer behaviours & attitudes | £ 1,500 | Order this section |

| Full Report | £ 3,250 |