The Lumina Intelligence Convenience Delivery Report is the definitive report on convenience market delivery, covering shopper behaviour and engagement with the channel and how this has changed.

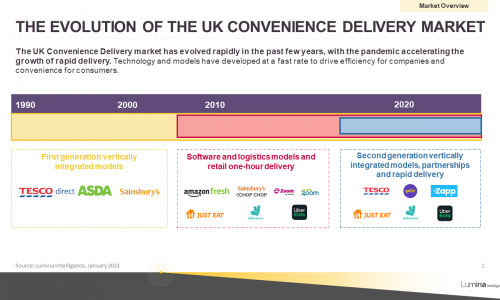

This report combines intelligence on external factors – including a detailed timeline of events within the delivery channel – with Lumina Intelligence consumer and shopper data to understand how behaviour towards the channel has evolved over recent times and how the impact of the coronavirus pandemic will affect it in the foreseeable future.

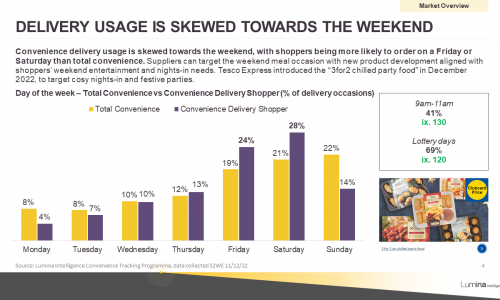

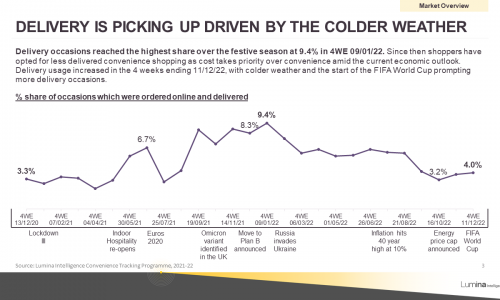

Explore key performance indicators of convenience delivery and how shoppers are engaging with the market compared to the average convenience shopping trip.

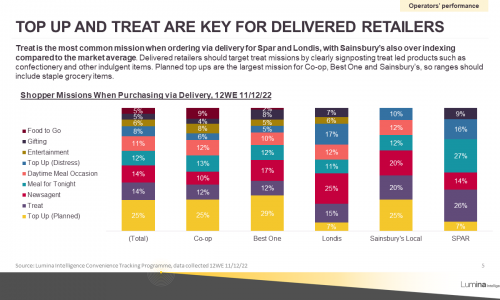

Understand the opportunities different missions bring and what retailers or delivery aggregators are winning with shoppers

Dive deep into who are the operators and retailers that leading the way and the key needs and requirements of consumers, including their future intentions towards the UK On-demand Convenience market.

This report is the ultimate analysis of the On-demand Convenience channel, giving you the knowledge you need to identify the opportunities this fast growing channel offers and generate a successful business strategy.

Market analysis:

- An overview of the convenience delivery market landscape in the UK

- What is the size of the UK convenience delivery market?

- How is the market evolving vs 2021/22?

- What growth is forecasted for 2023?

- What is driving these changes?

Consumer behaviour deep-dive:

- Frequency

- Main drivers

- Average consumption

- Basket analysis

- Shifts in consumer trends

Competitive landscape:

- How are business models changing?

- Which operators lead the market?

- How often do consumers use different operators for delivery?

- What are the latest developments with virtual brands?

- Which brands offer convenience delivery?

- What concepts need to be on your radar?

Future outlook:

- What are the trends that will impact the convenience delivery market?

- What growth is forecast over the next three years?

- What concepts are emerging within the convenience delivery market?

- What innovation will shape the convenience delivery market in the future?

Lumina Intelligence’s UK Convenience Tracking Programme (CTP) comprehensively measures and tracks consumer behaviour across all convenience retail shopping channels every week.

- Interviews with shoppers & non-shoppers at an annual sample size of 40,000+ weekly data collection

- Covering all major UK convenience groups

- Continuous data captured online and in-store