The Lumina Intelligence Pubs & Bars Market Report 2023 is a must-have review of the UK pub & bars market. Including market sizing and forecasts to 2026, up-to-date consumer behaviour insight and analysis of the current pub & bars competitive landscape, this report is a holistic source of intelligence on this channel for suppliers, operators, service providers and investors alike.

Market Insight

- Driving Growth in The Pub Market

- UK Forecast In 2023

- Consumer Confidence

- Pubs And Bars Market Value In 2023

- Pub Recovery in Relation to Total Eating Out Market

- Pub Market Developments: Legislation

- Pub Closure Forecast

- Managed Sites’ Turnover Share of Pub Market

- Pub Model Benefits and Challenges

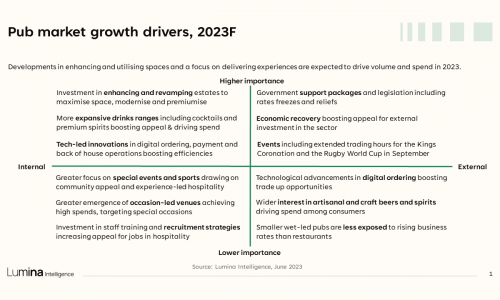

- Pub Market Growth Drivers, 2023f

- Pub Market Inhibitors, 2023f

Competitor Landscape

- Leading PUBS AND BARS forecast to see growth in 2023F

- Key pub group developments, September 22 – June 23

- Top 10 groups see turnover growth

- Economic headwinds see top groups offload sites

- Managed share sees growth from 2019 to 2023F

- Branded sites decline from 2019

- Managed non-branded pubs are performing strongly

- Groups aim investment into property development

- Investment in community divisions drives growth

- Leading groups launch initiatives to retain staff

- Leading groups use menu engineering to drive growth

- Leading groups are sustainability & community-focused

- Punch Pubs adopts people-centric approach to business

- Top 10 smaller pub groups by outlets

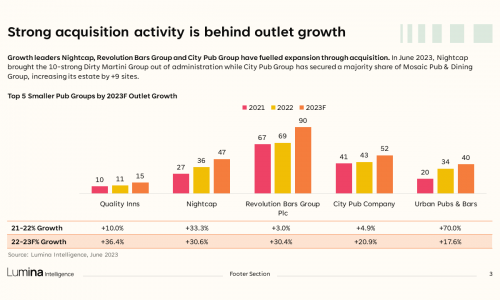

- Strong acquisition activity is behind outlet growth

- Growing groups aim to diversify or bolster offering

- Top 20 pub and bar brands by outlets (1-10)

- Top 20 pub and bar brands by outlets (11-20)

- Growth brands are polarised in offering

- Successful brands are looking to diversify formats

- Leading cocktail BARS seek to extend consumer base

- Concept to watch – Arrowsmith, O’Neill’s – Watford

- Concept to watch – Viajante 87, Notting Hill – London

Consumer Insight

- Consumers seek good value occasions from pubs

- Stagnant key metrics amidst the rising cost of living

- Consumers are prioritising value over quality

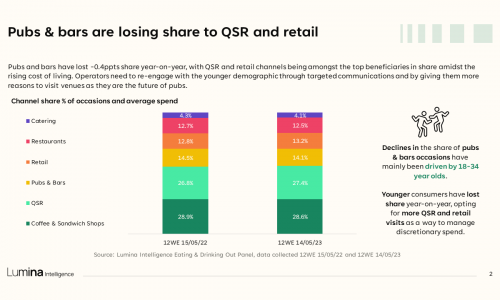

- Pubs and bars are losing share to QSR and retail

- Older demographics return to pubs and bars amidst few COVID concerns

- 55-64s are the most lucrative age group to target

- Indulgent items and low2no drinks are key to win 18-34s

- Poor weather leads to a decline in drink-only occasions

- Spend growth strongest at drink lunch occasions

- Pub operators targeting daytime meal occasions boost spend on weekdays

- Missions driven by treat and special occasions

- Growth of treat occasions drive by 25-34s & 55-64s

- Pub operators capitalising on affordable treats

- Offers for two drive partner occasions bringing average spend down year-on-year

- Opportunity to capitalise on growth of high street footfall

- Northwest becomes the leading region for pub and bar occasions

- Consumers are opting for value-led pubs

- Fewer drink-only occasions driven by 25-54s

- Pub favorite dishes are in growth

- Growth demand for vegetable-based dishes

- Consumers are cutting back on more expensive drinks

- Wider choice and new flavors drive cider occasions

- Consumers are more likely to not drink than last year

- Operators targeting non-drinkers with low2no drinks

- Non-alcoholic drink growth spurred by low2no trends

- Product And Price

- Pub And Bar Operators Driving Sales

- Methodology

- Drink Prices Increasing

- Operators Drive Drink Prices with Premium Range

- Same-Link Drink Prices YOY Growth

- Operators Encourage After Dinner Drinks

- Drink Trends

- Same-Line Dish Prices YOY

- Dish Counts Post Covid

- Burgers On Food Menus

- Chicken Burger Options on Menus

- Burgers And Upselling Opportunities

- Customisation And Price Premiums

- Sharing Dishes in Pubs and Bars

- Customisation And Sharing Dish Examples

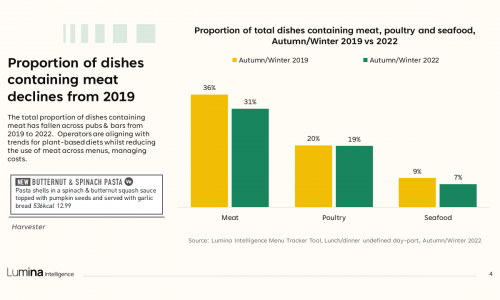

- Proportion Of Dishes Containing Meat

- Most Named Meat Replacement Brand

- Average Calorie Counts Across Menus

- Crispy, Hot Descriptors Display Flavor Trends

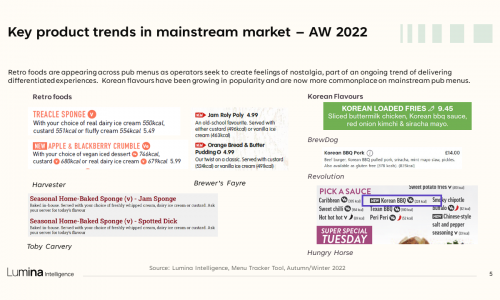

- Key Product Trends in Mainstream Marker AW2022

Future Outlook

- UK economic indicators expected to stabilize from 2024

- UK pubs and bars market value forecast 2026F

- Total eating out market growth in relation to pubs

- Net outlet closures are expected to end in 2025F

- Managed pubs market share forecast

- Pub market growth drivers, 2023F – 2026F

- Pub market growth inhibitors, 2023F-2026F

- Ongoing and emerging pub models

- Food-led pubs: future development expectation

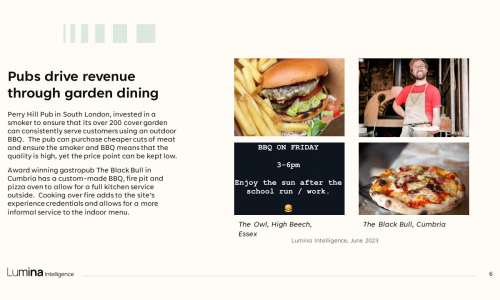

- Pubs drive revenue through garden dining

- Wet-led pubs: future development expectation

- Tequila poised to lead growth in spirits

- Experience-led pubs: future development expectation

- Pubs get creative with family events

Eating & Drinking Out Panel – Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and day-parts (including snacking)

2020-2023

Market Sizing & Operator Data Index – Market sizing data tracking the performance of hospitality and grocery operators, based on turnover and outlet numbers

Extracts from Operator Data Index and wider synthesis with total Eating Out market sizing

Lumina Intelligence Operator Data Index tracks and forecasts outlet and turnover information for over 400 brands across the eating out market

2017-2026F

Menu Tracker – Lumina Intelligence’s Menu Tracker tool tracking menu data from 80 operators across the Eating Out market

Managed pub/bar operator menus analysed in the report

Autumn/Winter 2019-2022

Secondary external sources – Lumina Intelligence also uses external sources including desk research, GFK Consumer Confidence Index and EY Item Club economic indicators

Download the sample

| Section | Price | |

|---|---|---|

| Market Insight & Future Outlook | £ 1,500 | Order this section |

| Competitive Landscape | £ 1,500 | Order this section |

| Consumer Insight & Product+Price | £ 1,500 | Order this section |

| Full Report | £ 3,250 |