Use this report to understand how coronavirus has impacted consumer behaviour and arm yourself with the insight you need to inform critical business decisions, in order to maximise the opportunities and tackle the challenges on the horizon.

This report combines intelligence on external factors – including a detailed timeline of events and macro-economic data – with HIM/ MCA Insight consumer and shopper data to understand behaviour pre coronavirus and during peak coronavirus quarantine.

We identify the likely winners and losers and combine this with consumer research regarding future intentions to build possible future scenarios of what post coronavirus/adjusted normality could look like, including implications and recommendations.

How to use the report

Operators & Retailers

- Understand how the eating out and grocery retail markets could look post coronavirus

- Identify who we expect to be the winners and losers. What does this mean for your business?

- Understand how shopping habits have changed and align your strategy to maximise potential.

- Develop your knowledge of consumers and how they responded to not being able to eat out

- Identify the trends that are likely to still be important in adjusted normality

Suppliers

- Understand how the eating out and grocery retail markets could look post coronavirus

- Align your channel strategy to the forecasted trends in the market

- Understand where best to invest your time, people and money

- Understand how shopping habits have changed and align your strategy to maximise potential.

- Develop your knowledge of consumers and how they responded to not being able to eat out

- Identify the trends that are likely to still be important in adjusted normality

Investors

- Understand how the eating out and grocery retail markets could look post coronavirus

- Identify who we expect to be the winners and losers. What does this mean for your business?

- Understand how shopping habits have changed and align your strategy to maximise potential.

- Develop your knowledge of consumers and how they responded to not being able to eat out

- Identify the trends that are likely to still be important in adjusted normality

Executive Summary

Coronavirus Key Events Timeline

PEST Analysis

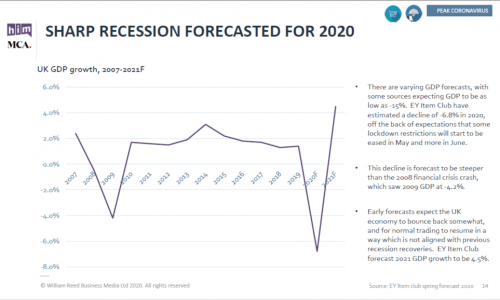

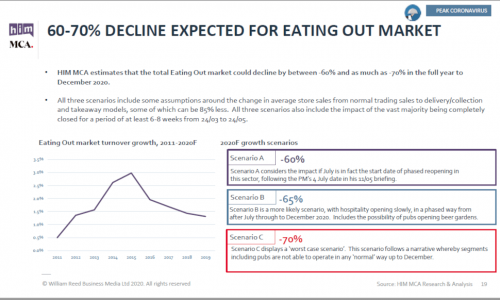

(Political, Economic, Social, Technological) analysis of the external environment and the impact coronavirus has had on each.

Consumer And Shopper Insight

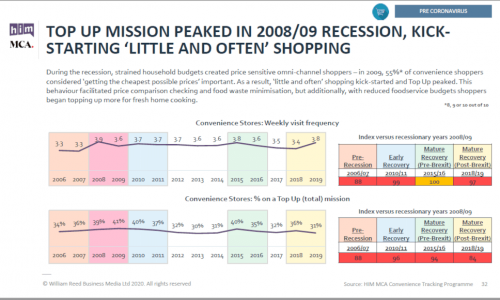

Key consumer metrics and insight on shopping and eating out behaviour pre and peak coronavirus, including analysis of historic data to unpick how this was affected by the last economic downturn.

The Dynamic Meal Equation

The Dynamic Meal Equation (typical make up of meals consumed in/out of home) and how this has changed pre coronavirus vs. peak coronavirus quarantine, plus some scenarios for how this could look in ‘adjusted normality’.

Scenario Planning

Quadrant style mapping, which works through possible scenarios, highlighting key implications, opportunities and business development recommendations.

MCA Eating Out Panel comprising 72,000 surveys across the year

- HIM flagship Consumer Tracking Programme incorporating 20,000 shopper interviews a year

- MCA/HIM’s brand new Channel Pulse survey, our weekly measure of consumer behaviour and attitudes across channels from a nationally representative sample of 1,000 consumers

- Economic trends available from external sources such as ONS, with our own advanced analysis techniques applied

- Bespoke consumer study specifically for this report

- The report will be compiled by an experienced team of analysts and informed by comments and opinion from across the industry, including journalists, retailers, suppliers, wholesalers and investors.