The Lumina Intelligence Top of Mind Report – 2023 provides business leaders with valuable insight into key market developments and the most critical business challenges and issues currently facing the UK Eating Out market and Grocery Retail market. With the aim to help validate and benchmark internal perspectives.

Despite challenging trading conditions anticipated to persist for 85% of grocery and 83% of hospitality leaders, a glimmer of optimism shines in the hospitality sector, where 23% foresee improved conditions due to easing inflation. Value consciousness is on the rise, and recruitment challenges have eased slightly in grocery and eating out, but Brexit remains a key obstacle in staffing, particularly in the hospitality sector.

Market Context

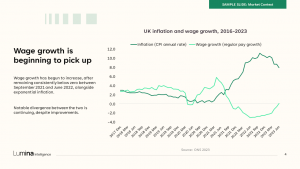

- Inflation and higher interest rates

- Wage growth

- Interest rates

- Consumer Confidence

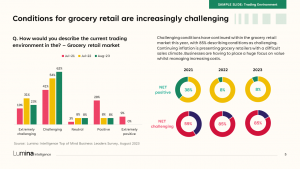

Trading Environment

- Grocery retail conditions

- Condition expectations for next year

- Positive outlook and inflation

- Continuing cost of living

- Food service positivity

- Optimism in the eating out market

- Optimism about inflation

- Rising interest rates

Market Trends

- Finance driven factors

- Experience and its influence in eating out

- Top 3 trends across grocery and hospitality

- Consumer need for value

- Businesses and new initiatives in 2023

- Sustainability initiatives

Challenges and Opportunities

- Improvements in challenges faced by businesses

- Pricing challenges

- Eating out businesses and rising costs

- Eating out market and staffing challenges

- Brexit, shifting attitudes, and low pay

- Schemes to attract staff

- Decreases in footfall in eating out and grocery

- Businesses focus on reviewing processes and prices

- Impact of calorie labelling on menus

Most Admired Brands

- Companies aligned with consumers

- Consistency and innovation in foodservice

Top of Mind Business strategy

Lumina Intelligence Top of Mind business leaders survey is an online questionnaire targeted at industry professionals across the eating out and grocery retail markets, focused on understanding the current trading environment, challenges and growth opportunities.

It is based on responses from c.71 leaders working in senior management positions.

The survey was carried out from June-August 2023 and data has been compared to the previous two waves, collected in June-July 2021 and June-July 2022.

Supporting data sources

Eating and Drinking Out Panel

Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and day-parts (including snacking).

2020 – present

Convenience Tracking Programme

Lumina Intelligence’s UK Convenience Tracking Panel (CTP) – Interviews with shoppers & non-shoppers at an annual sample size of 40,000+ weekly data collection in all major UK convenience groups. Continuous data captured online and in-store

2020 – present