The Lumina Intelligence Top of Mind Report 2025 provides a comprehensive analysis of the current and future business climate across the UK Eating Out and Grocery Retail markets. It explores how trading environments are expected to evolve over the next 12 months, examining the factors influencing these shifts. The report highlights the long-term consumer trends shaping both sectors, offering insight into changing behaviours and preferences.

It also investigates the business initiatives being prioritised, from innovation and operational efficiency to customer engagement, giving leaders a clear view of where the industry is focusing its efforts. In addition, the report addresses critical challenges such as attracting and retaining staff, explores labour market conditions and potential solutions, and showcases the most admired brands in the sector, providing examples of successful strategies and best practice.

Who is this report for?

This report is essential for retail and hospitality operators seeking to benchmark trading performance and business sentiment, suppliers and manufacturers developing strategies to align with retail and out-of-home partners, investors and analysts assessing market confidence, growth potential, and brand performance, as well as consultants and advisors supporting commercial planning and category strategy.

What questions will this report help you answer?

- What are the biggest challenges currently facing the UK Eating Out and Grocery Retail markets?

- How do business leaders expect trading conditions to evolve over the next 12 months?

- Which consumer trends are shaping behaviour and influencing business strategy?

- How are companies managing labour, cost pressures and sustainability targets?

- Which brands are most admired in 2025 — and what drives their success?

MARKET CONTEXT

- Economic Overview – Analysis of macroeconomic conditions influencing trading performance, including GDP, inflation, and fiscal policy.

- Graph: Key economic indicators, EY Item Club, 2023–2028F

- Consumer Confidence & Spending Outlook – Examination of household sentiment, financial pressures, and expectations for the year ahead.

- Graph: GfK Consumer Confidence, September 2019 – September 2025

- Inflation & Wage Dynamics – Comparison of consumer price inflation and average earnings growth, highlighting affordability pressures.

- Graph: UK inflation and wage growth, 2018–2025

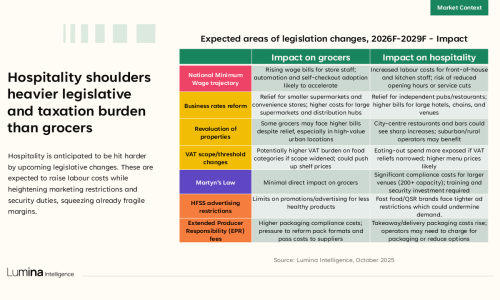

- Legislative & Political Landscape – Overview of government policies affecting labour markets, business rates, and energy costs.

- Graph: Expected areas of legislative change, 2026F–2029F – Impact matrix by sector

- Sector Comparison: Grocery vs Hospitality – Summary of how upcoming legislation and taxation will affect margins and operating costs in each market.

- Graph: Comparative chart of key legislative impacts, 2026–2029

TRADING ENVIRONMENT

- Current Trading Conditions – Grocery Retail – Analysis of operating performance, cost pressures, and investment confidence.

- Graph: Grocery market trading environment – net positive vs net challenging (2022–2025)

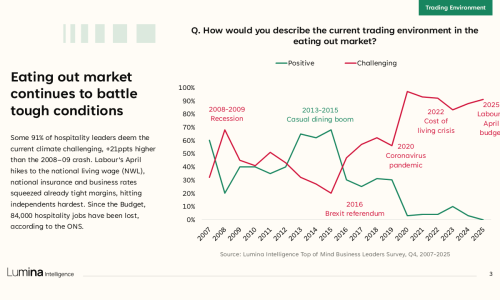

- Current Trading Conditions – Hospitality – Overview of the ongoing pressures facing operators, including cost inflation and labour shortages.

- Graph: Eating out market trading environment – net positive vs net challenging (2022–2025)

- Historical Context: Hospitality Resilience – Long-term comparison of business sentiment versus key macro events.

- Graph: Eating out market sentiment compared with 2008–09, 2020, and 2025

- 12-Month Market Outlook – Future expectations for trading conditions across both sectors.

- Graph: Expected trading development next 12 months – Grocery vs Hospitality (2024–2025)

- Market Pressures & Closures – Insight into anticipated closures, reduced investment, and operational shifts in the year ahead.

- Graph: Anticipated hospitality closures and investment activity, 2025

- Leadership Commentary – Qualitative insights from business leaders on resilience, stabilisation, and growth expectations.

MARKET TRENDS

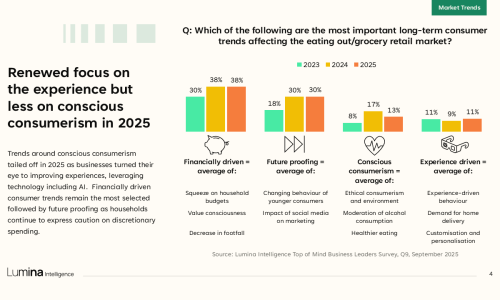

- Consumer Trend Landscape – Overview of long-term consumer behaviours influencing both markets, from value-consciousness to digital engagement.

- Graph: Leading long-term consumer trends, 2023–2025

- Value vs Experience Priorities – Discussion on the evolving balance between affordability, experience, and conscious consumption.

- Graph: Financially driven, experience-driven, and ethical trend segmentation (2023–2025)

- Hospitality Value Innovation – Case examples of new meal deal propositions and value-led offers driving customer retention.

- Visual Examples: Brand-led product launches and promotional innovations, 2025

- Business Priorities & Initiatives – Exploration of internal business priorities including NPD, staff training, and sustainability.

- Graph: Initiatives being prioritised in the next 12 months – Grocery vs Hospitality

- Health & Wellness Initiatives – Examination of product and menu innovation in health, HFSS compliance, and functional ingredients.

- Graph: Health and nutrition initiatives prioritised by businesses, 2025

- Sustainability & Environmental Focus – Review of business-led environmental strategies including carbon reduction and supply chain efficiency.

- Graph: Sustainability initiatives by focus area – food waste, emissions, and packaging reduction

CHALLENGES & OPPORTUNITIES

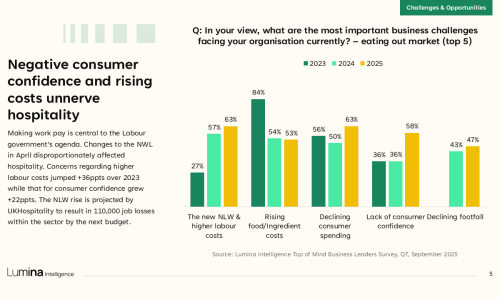

- Key Business Pressures – Analysis of the top challenges facing leaders, including labour costs, regulation, and declining confidence.

- Graph: Top five business challenges – Grocery Retail and Hospitality (2023–2025)

- Operational Adaptation – Overview of strategic responses to rising costs and labour challenges.

- Graph: Mitigation strategies adopted – labour management, automation, restructuring

- Sector Case Study: Technology & Efficiency – Case example demonstrating how digital platforms improve productivity and operational agility.

- Visual Example: Case study on integrated tech solution improving multi-site labour performance

- Regulatory Impact & Compliance – Discussion on HFSS legislation, cost implications, and market adaptation.

- Graph: Expected effects of HFSS regulation on consumer behaviour

- Investment Priorities – Review of planned investments in digitalisation, AI, and automation to strengthen competitiveness.

- Graph: Business investment focus areas – 2025–2026

MOST ADMIRED BRANDS

- Grocery Retail Leaders – Overview of the most admired grocery brands, highlighting adaptability, consumer relevance, and innovation.

- Graph: Grocery retail admiration matrix – adaptability, strategy, and ethics

- Hospitality Leaders – Examination of brands recognised for culture, menu innovation, and operational excellence.

- Graph: Hospitality admiration matrix – brand positioning, innovation, and quality

- Key Attributes of Admired Brands – Summary of the qualities driving admiration across both sectors.

Top of Mind Business Leaders Survey (2025):

An online survey of 46 senior decision-makers across grocery retail and hospitality, conducted from June–September 2025, benchmarking performance and priorities year-on-year.

Supporting Data Sources:

- Eating & Drinking Out Panel – Weekly tracking of 1,500 consumers (78,000 annually) across all UK eating out channels and occasions.

- Convenience Tracking Programme (CTP) – Survey-based dataset capturing 1,500 weekly responses (78,000 annually) from UK convenience shoppers.