About the Report

The Lumina Intelligence UK Eating Out Market Report 2025 is the definitive source of insight for operators, suppliers, and manufacturers seeking a complete view of the out-of-home food and drink sector. This comprehensive report quantifies the market’s size and value to 2028, examines what’s fuelling its growth, and explores the potential barriers that could shape its future trajectory. It draws on robust data from Lumina Intelligence’s Eating and Drinking Out Panel, which surveys 1,500 consumers weekly, offering unparalleled visibility into evolving behaviours and habits.

Covering the total market landscape, this report explores performance across key channels and leading operators, and delves into how consumer preferences are shifting. It also provides forward-looking forecasts, helping businesses understand where the greatest opportunities lie. Whether you’re monitoring competitive dynamics, planning strategic investments, or tracking consumer sentiment, this report offers the evidence and clarity needed to make informed decisions in a rapidly evolving market.

How to Use It

This report is an essential strategic planning tool for businesses in the UK eating out market. It enables operators to benchmark performance, identify growth opportunities, and enhance their value propositions. Suppliers and manufacturers can align their offerings with consumer demand, while investors and analysts can leverage market sizing data and forecasts to assess sector resilience and growth potential.

Who Is It For?

The UK Eating Out Market Report 2025 is crucial for foodservice operators, suppliers, manufacturers, investors, and analysts aiming to understand the latest trends and dynamics of the market. Whether you are an established brand, an emerging operator, or a supplier looking to expand, this report provides the insights needed to navigate the evolving landscape and seize growth opportunities.

Questions This Report Answers

Market Insight

- What does the UK eating out market look like in 2025, and how will it evolve in the coming years?

- What are the key commercial, financial, and economic trends shaping market performance?

- Which sectors and formats are driving growth, and where are the gaps in the market?

- How will inflation, cost pressures and macroeconomic conditions impact business forecasts?

Competitive Landscape

- Who are the leading operators and brands across key channels, and how are they performing?

- What strategies are businesses using to drive growth, innovation, and market share?

- Which formats and operating models are proving most resilient in a competitive environment?

- How is the competitive landscape evolving across hospitality, retail, and leisure foodservice?

Consumer Insight

- How are consumer behaviours and attitudes towards eating and drinking out changing in 2025?

- What factors are motivating consumers to choose one brand or channel over another?

- Which demographics are driving growth, and how can businesses target them more effectively?

- What role do value, health, and quality play in influencing consumer choice?

Future Outlook

- How will the eating out market grow between 2025 and 2028?

- What are the major drivers and inhibitors of future performance across different channels?

- How could upcoming regulatory and political changes affect the market outlook?

- What strategic opportunities and risks should businesses plan for over the next three years?

Market Insight

- Overall Market Performance – Overview of market growth, key structural shifts, and segmentation between service-led and quick service channels.

- Economic Influences – Evaluation of macroeconomic indicators, policy impacts, and inflationary pressures affecting business and consumer decision-making.

- Consumer Confidence and Spending Power – Summary of consumer confidence trends and financial disparities shaping market participation.

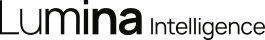

- Competitive Channel Dynamics – Comparison of how different eating out formats perform and adapt to external pressures.

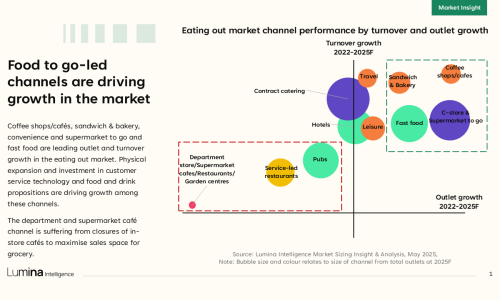

- Outlet Expansion and Format Strategies – Analysis of net outlet growth, format innovation, and the influence of franchise and low-capex models.

- Market Segmentation Insights – Deep dive into performance across retail, travel & leisure, hotels, pubs, restaurants, and contract catering.

- Key Market Challenges – Discussion of rising costs, labour availability, and other structural challenges facing operators.

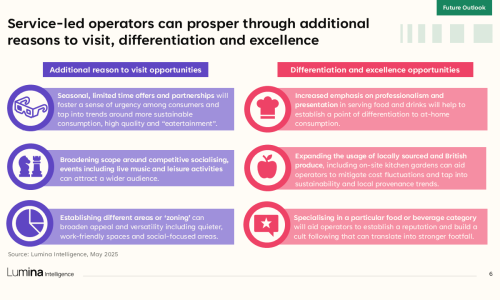

- Growth Drivers and Opportunities – Identification of the market’s most promising growth areas including tourism, technology, and new product formats.

Competitive Landscape

- Market Overview – Examination of current competitive pressures and how leading brands are responding to market uncertainty.

- Top Companies Performance – Performance overview of the top 10 operators by turnover, including market share analysis.

- Leading Operators and Brand Strategies – Review of operator-level strategies around innovation, optimisation, and repositioning.

- Outlet Share and Expansion Trends – Summary of outlet growth by brand, including the role of franchising and site segmentation.

- Innovation and Digital Integration – Exploration of how operators are embedding digital tools, loyalty schemes, and AI to enhance performance.

- Sector Consolidation – Overview of M&A activity, private equity involvement, and estate rationalisation shaping the competitive landscape.

- Emerging Competitors – Profile of challenger brands gaining market share through differentiation and agility.

- Strategic Partnerships and Alliances – Key collaborations, cross-channel innovations, and delivery integrations driving growth.

Consumer Insight

- Consumer Demographics and Profiles – Demographic breakdown of eating out participation by age, income, and region.

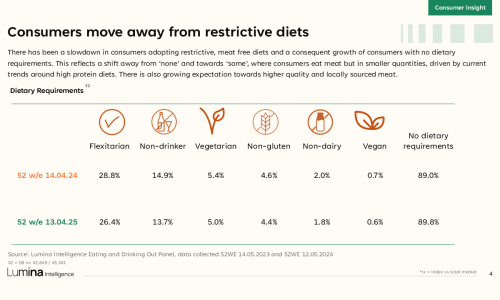

- Consumer Behaviour Trends – Overview of frequency, penetration, and evolving behaviours across channels and day-parts.

- Motivations and Decision Drivers – Insights into the main drivers of consumer choice, including value, quality, health, and convenience.

- Channel Preferences and Usage – Summary of how consumers are interacting with QSR, pubs & bars, cafés, and service-led formats.

- Occasion Dynamics – Analysis of consumer motivations across different occasions such as lunch, dinner, drinks, and treat missions.

- Location-Based Behaviour – Insights into growth across city centres, high streets, and other key locations.

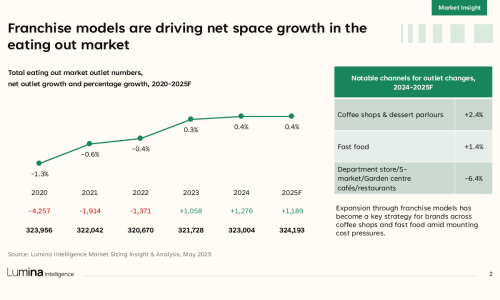

- Loyalty and Digital Engagement – Examination of consumer engagement with loyalty schemes and in-app reward mechanisms.

- Health and Wellness Priorities – Overview of growing consumer interest in health-led menu choices and functional drinks.

Future Outlook

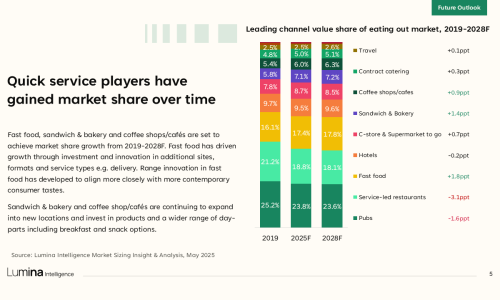

- Market Growth Projections – Forecast of market value and volume growth out to 2028, including projections by channel.

- Economic Factors – Discussion of how future inflation, wage trends and policy developments may affect the market.

- Channel Performance Forecasts – Forward-looking assessment of growth trajectories across food to go, delivery, service-led and contract catering.

- Consumer Spending Outlook – Projections for changes in consumer discretionary spend, value expectations, and health preferences.

- Expansion and Format Evolution – Expected trends in physical estate development and investment in format diversification.

- Regulatory and Legislative Outlook – Anticipated impact of political and regulatory developments following the 2024 General Election.

- Emerging Trends – Strategic overview of high-impact trends including automation, digitalisation, and format innovation.

Data Sources

Eating & Drinking Out Panel

Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year. This covers all eating out channels and day-parts (including snacking), from 2020 to 2025.

Market Sizing & Operator Data Index

Market sizing data tracks the performance of hospitality and grocery operators based on turnover and outlet numbers. This includes extracts from the Operator Data Index and synthesis with total Eating Out market sizing. The Lumina Intelligence Operator Data Index tracks and forecasts outlet and turnover information for over 400 brands across the eating out market, from 2019 to 2028F.

Secondary External Sources

Lumina Intelligence also uses external sources, including desk research, the Office for National Statistics (ONS), GfK Consumer Confidence Index, and EY ITEM Club economic indicators.

Download the sample

Not sure if this report is right for you?

Speak directly with one of our expert analysts to understand what’s covered, and how it can support your business goals.