About the Report

The UK food-to-go market is forecast to grow by +3.3% in 2025, reaching a value of £24bn. This growth trajectory sees the sector outpacing the total eating-out market, driven by changing consumer habits, innovation in products and formats, and increased competition among key players.

The Lumina Intelligence UK Food to Go Market Report 2025 provides an in-depth analysis of the rapidly evolving food-to-go sector. It examines how operators are adapting through location strategies, format innovation, and new product development, while also identifying the key trends shaping consumer behaviour. The report explores the opportunities and challenges facing the market, from shifting customer expectations to the wider influences impacting UK hospitality.

With insights into market sizing, competitive performance, consumer behaviour, and future forecasts to 2028, this report provides a deep dive into the strategies of leading brands, the latest food and drink trends, and the megatrends that will define the future of food to go.

How to Use It

This report serves as a strategic tool for businesses looking to stay competitive, make informed decisions, and capitalise on growth opportunities. It helps users understand market shifts, consumer expectations, and the strategies of leading brands. Readers can use the insights to refine business models, product offerings, pricing strategies, and marketing approaches. With forward-looking forecasts to 2028, it also helps businesses anticipate future trends, risks, and opportunities, ensuring they remain ahead in a fast-changing market.

Who Is It For?

The report is essential for food-to-go operators, suppliers, wholesalers, and investors, as well as commercial, finance, data, insight, brand, and marketing teams. Operators can use it to assess their market position and competitive strategy, while suppliers and wholesalers gain insights into customer priorities and market demand. Investors benefit from a clear view of market performance, key players, and future growth potential, enabling smarter investment decisions. Whether expanding into new channels, launching new products, or planning long-term strategies, the report provides the intelligence needed to succeed.

Executive Summary

- Introduction & How to Use This Report – Overview of the report structure and guidance on navigating key insights.

- Key Takeaways – Summary of the main findings on market trends, growth areas, and challenges for food to go in 2025.

Market Insight

- Overall Market Performance – Analysis of market growth expectations, key drivers, and economic influences shaping the sector.

- Graph: Key economic indicators, EY Item Club, 2019-2025F

- Economic and Consumer Confidence Indicators – Assessment of economic factors including inflation, employment costs, and consumer sentiment.

- Graph: GFK consumer confidence, February 2020 – February 2025

- Competitive Market Positioning – Examination of how food to go is expected to perform relative to the total eating out market.

- Graph: Average weekly discretionary income by household income group, December 2024, with percentage year-on-year growth

- Graph: Transport usage – percentage versus pre-covid usage

- Retail and Location Trends – Insights into outlet expansion, key high-footfall locations, and shifting consumer behaviours.

- Graph: UK food to go market value in millions, with percentage growth, 2019-2025F

- Graph: UK food to go market share of total eating out market, 2019-2025F

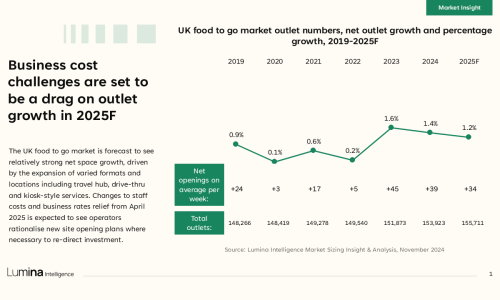

- Operational Challenges and Cost Pressures – Discussion on rising costs, staffing challenges, and the impact on business growth.

- Graph: UK food to go market outlet numbers, net outlet growth and percentage growth, 2019-2025F

- Key Growth Enablers – Exploration of factors driving food to go expansion, including convenience trends and digital innovation.

- Graph: Leading channel share of food to go market, 2022-2025F

Competitive Landscape

- Operator Performance Analysis – Overview of leading food to go operators and their market strategies.

- New Product Development Trends – Examination of product innovation, including menu expansions and consumer-driven offerings.

- Pricing Strategies – Analysis of price positioning, discounting strategies, and value-driven propositions in the market.

Consumer Insight

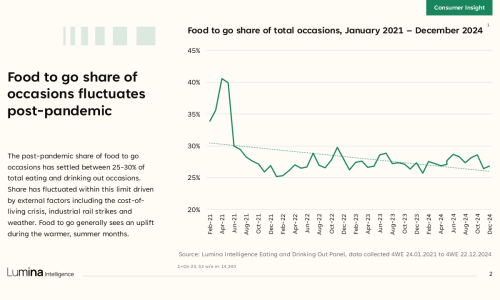

- Consumer Behavior & Spending Trends – Insights into changing consumer preferences, purchasing habits, and spending power variations by income group.

- Graph: Food to go share of total occasions, January 2021 – December 2024

- Demographic Shifts – Analysis of the dominant consumer groups shaping food to go, including age, income, and employment-based influences.

- Day-Part & Occasion Trends – Examination of key consumption moments, including lunch, snacking, and commuting patterns.

- Health and Quality Considerations – Overview of evolving consumer priorities around health, premium products, and food quality.

- Graph: Food to Go – very value led and penetration ppt change by income

- Graph: Food to go share of total eating out market occasions – outlet location

- Graph: Food to go share of total eating out market occasions – region

- Graph: Food to go occasions by day of the week

- Graph: Food to go missions – total market

- Graph: Day-part split of total FTG occasions

- Graph: Food to go – lunch– share and year on year changes

- Graph: Channel share of food to go occasions

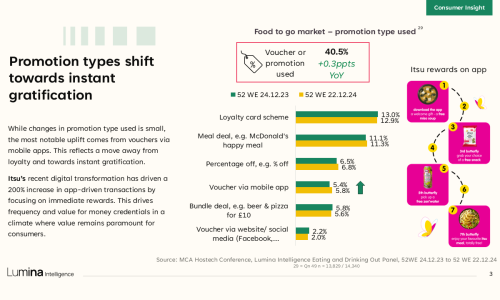

- Digital and Loyalty Trends – Insights into how technology, loyalty programs, and social media influence food to go purchases.

- Graph: Brand share of food to go occasions

- Graph: Food to go occasions: top reasons for choosing an establishment

- Graph: Food to Go consumer – Psychographics – occasion %

- Graph: Food to go market – promotion type used

- Graph: Food to Go – Consumer Dietary Requirements

- Graph: Top 10 food items consumed by daypart to go – Lunch

- Graph: Top 10 food items consumed by daypart to go – Snack

Growth Opportunities

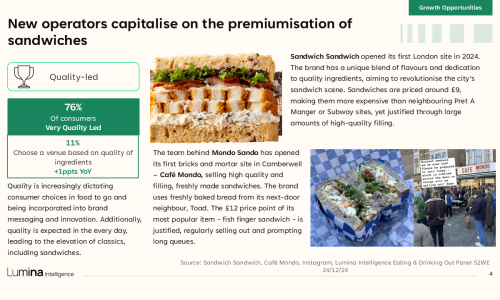

- Emerging Consumer Preferences – Exploration of rising trends, including demand for personalized food options, premium ingredients, and healthier offerings.

- Graph: What are the most important long term consumer trends impacting the F&B industry?

- Graph: Reasons for choosing establishment

- Brand Differentiation Strategies – Analysis of how operators can leverage branding, aesthetics, and social media engagement to drive footfall.

- Technology and Service Innovations – Examination of automation, AI, and digital ordering advancements shaping the industry.

- Expansion into New Consumption Moments – Discussion of how operators are adapting to evolving food-to-go occasions and meal patterns.

- Sustainability & Ethical Considerations – Insight into evolving consumer priorities related to sustainability, responsible sourcing, and environmental concerns.

- Graph: Sustainability – Businesses vs Consumers

Future Outlook

- Market Growth Projections (2025-2028) – Forecasts for the food to go sector, highlighting expected market size and key drivers of expansion.

- Graph: Key economic indicators, EY Item Club, 2022-2027F

- Graph: UK food to go market value in millions, with percentage growth, 2024-2028F

- Graph: UK food to go market share of total eating out market, 2023-2028F

- Graph: Food to go turnover by key channels in millions, 2022-2028F

- Investment & Innovation Priorities – Overview of investment areas, including outlet expansion, technology adoption, and operational efficiencies.

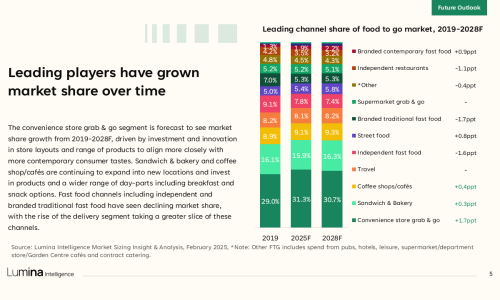

- Competitive Shifts & Market Leaders – Analysis of how leading channels will evolve and which segments will drive the strongest growth.

- Graph: UK food to go market outlet numbers, net outlet growth and percentage growth, 2023-2028F

- Graph: Leading channel share of food to go market, 2019-2028F

- Graph: Top 10 food to go channels ranked by absolute growth in £ millions, 2025F-2028F

- Macroeconomic Impact & Consumer Spending Trends – Projections on economic trends, wage growth, and their implications for food to go.

- Long-Term Industry Trends (2025-2028) – Identification of transformative trends shaping the industry over the next three years.

Brand Insights Available in the UK Food to Go Market Report 2025

Tesco

- Insight on Tesco’s food to go market performance, including revenue growth.

- Details on Tesco’s best-performing food categories and innovations.

- Evaluation of Tesco’s strategy in food to go, including competitive positioning.

Greggs

- Analysis of Greggs’ market share and its year-on-year growth.

- Consumer preferences for Greggs, including top reasons for customer loyalty.

- Insight into Greggs’ expansion strategy and new store formats.

M&S

- Overview of M&S’s position in the premium food to go sector.

- Trends in consumer demand for M&S’s healthier food to go offerings.

- Insights on product innovation and category performance.

McDonald’s

- Analysis of McDonald’s role in the food to go market.

- Performance of McDonald’s meal deals and consumer appeal.

- Insight into digital ordering trends and technology investments.

Subway

- Details on Subway’s market position and recent store changes.

- Insight into consumer engagement with Subway’s menu offerings.

- Trends in Subway’s delivery and takeaway performance.

Costa

- Evaluation of Costa’s food to go segment and customer preferences.

- Analysis of Costa’s beverage-led strategy in food to go.

- Performance of Costa’s loyalty and digital engagement initiatives.

Other Brands Mentioned

- Co-op

- Waitrose

- Spar

- Itsu

- Popeyes

- Leon

- Wasabi

- Pret A Manger

- Joe & The Juice

- KFC

- Boots

- WHSmith

- Aldi

- Lidl

- Pepe’s Piri Piri

- PizzaExpress

- Gail’s Bakery

Eating & Drinking Out Panel

- Lumina Intelligence’s UK Eating & Drinking Out Panel tracks the behaviour of 1,500 nationally-representative consumers each week, building up to a sample of 78,000 every year, across all eating out channels and day-parts (including snacking) 2021-2025

Market Sizing & Operator Data Index

- Market sizing data tracking the performance of hospitality and grocery operators, based on turnover and outlet numbers

- Extracts from Operator Data Index and wider synthesis with total Eating Out market sizing

- Lumina Intelligence Operator Data Index tracks and forecasts outlet and turnover information for over 400 brands across the eating out market 2019-2028F

Secondary external sources

- Lumina Intelligence also uses external sources including desk research, GFK Consumer Confidence Index and EY Item Club economic indicators