About the Report

The Lumina Intelligence Forecourt Market Report 2025 provides a comprehensive overview of the UK forecourt retail market, analysing its size, structure, key drivers, and future growth opportunities. It offers detailed insight into the evolving role of forecourts as multi-purpose retail destinations, examining leading and innovating operators, supplier relationships, and consumer expectations. The report features exclusive research from Lumina Intelligence’s bespoke consumer and operator surveys, exploring shopper missions, operator’s approaches to dwell times, brand and quality influences, and food-to-go demand. With a section devoted to the future outlook of the forecourt market, it also addresses challenges such as the shift towards convenience, competition from evolving retail formats, and the need for enhanced digital engagement, empowering businesses with the knowledge to stay ahead in a rapidly changing landscape.

How to Use It

This report serves as a strategic planning tool for businesses operating within, or looking to enter, the forecourt retail channel. It equips operators with the knowledge of which missions will grow continue to grow – which in turn has a huge influence on store flows and merchandising, identify emerging consumer priorities, and optimise their offering to boost dwell time and loyalty. Suppliers and wholesalers can use the insights to align product portfolios with evolving shopper behaviours and anticipate new retail partnerships. Investors and commercial teams can leverage competitive analysis and future outlook insight to assess growth potential, sector resilience, and strategic investment opportunities across the convenience and forecourt sector.

Who Is It For?

The Lumina Intelligence Forecourt Market Report 2025 is essential for forecourt operators, suppliers, wholesalers, and investors seeking to understand the latest trends, challenges, and opportunities within the market. Whether you are an established operator refining your retail strategy, a supplier expanding into the forecourt channel, or an investor exploring emerging retail sectors, this report provides the critical insights needed to navigate the market and unlock future growth potential.

Questions This Report Answers

Lay Of The Land

- What are the key concerns for forecourt operators currently?

- What are the key factors in consumer decision making?

- What can drive footfall increases in forecourt convenience stores?

- How are forecourt consumer attitudes (psychographics) evolving?

- What are the key levers that operators and brands can pull on to drive more impulse purchases?

Shopper Missions

- Which missions are gaining traction and should expect to flourish further in forecourts?

- Which locations in-store should be utilised to appeal to the missions and convert more impulse purchases?

- What are the consumption occasions that brands should appeal to?

- What categories are vital to leverage by mission for forecourt operators?

Local Distinctions (Urban, Semi-Urban and Rural)

- Which locations are important? Which are growing in importance?

- Which shopper demographics are important by location?

- What credentials (e.g. quality) are shoppers looking for?

- Which shopper missions shine through by location?

- Case studies: Venues and forecourt brands leading trends

Future Outlook

- What are operator expectations for trading in the future?

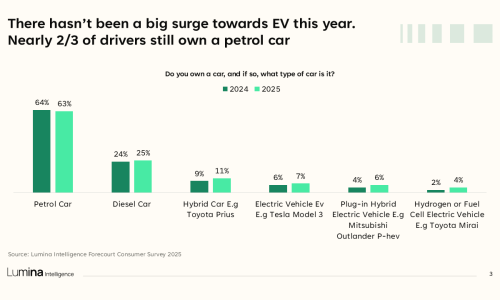

- What opportunities do the move to electric vehicles present?

- What will we see more of in the spaces of: digital, partnerships and services?

Executive Summary

- Key Market Insights

- Sector Challenges and Opportunities

- Consumer Trends and Evolving Shopper Behaviour

Lay of the Land

- Market Overview and Structure

- Graph: Current trading environment descriptors in the forecourt sector

- Graph: Most important business challenges

- Graph: Trading conditions expectations in the next 12 months?

- Key players, ownership models, and competitive dynamics

- Graph: Convenience key measures – Q1 2025

- Competitive Landscape: Leading Brands and Market Shares

- Fuel Market Analysis: Price Trends and Consumer Impact

- Graph: Forecourt type’s share of all forecourt trips

- EV Charging Expansion: Growth of Charging Infrastructure

- Graph: Top 5 brand of petrol station used to re-fuel/ EV charge

- Operator Insights and Performance

- Graph: Operator top 5 services on site

- Graph: Mode of transport used to visit outlet

- Graph: Biggest changes seen by operators in the last 12 months

- Key Trends Shaping Forecourt Retail

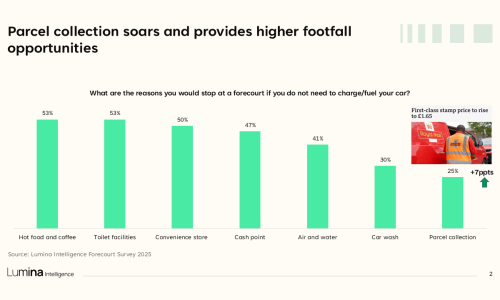

- Graph: Reasons to stop at a forecourt aside from charge/fuel

- Graph: Forecourts vs convenience average – psychographics of shoppers

- Graph: What does a good convenience store mean to you? (top five)

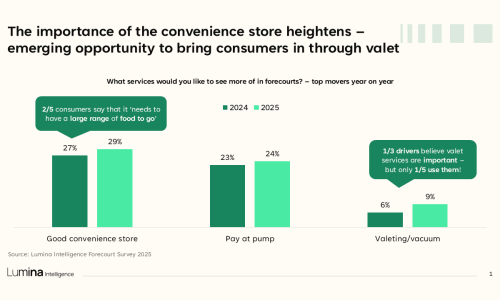

- Graph: What services would you like to see more of in forecourts? – top movers year on year

- Graph: In the next five years, how important will those services be for your forecourt shop?

- Graph: % of purchases made impulsively

- Graph: Reason for impulse purchase

- Graph: Location in store of impulse purchase

- Graph: Time of day of impulse purchase

Shopper Missions Deep Dive

- Understanding Core Shopper Missions

- Graph: Long-term mission growth in share, size of mission and importance vs Total Convenience. 2025 vs 2022

- The Rise of Food to Go and Coffee

- Graph: What services would you like to see more of in forecourts? – top movers year on year

- Graph: Occasion purchase made for – FTG missions trips %

- Graph: Where picked up in store – % trips

- Graph: Top 10 impulse sectors featuring in meal deals – % of occasions they feature in. Total Convenience average

- Graph: % of occasions when the category is purchased

- Graph: Top 10 products shoppers buy on 1-item and 2-item trips in forecourts

- Planned Top-Ups: Essential Purchases and Fresh Offerings

- Graph: Planned top-up mission share of forecourt missions, 2023-2025

- Graph: Living situation splits

- Graph: Reason for impulse purchase – top 5 – planned top up – forecourt

- Graph: Basket analysis – top 10 categories purchased on planned top-up missions – forecourt

- Graph: Top 5 product consideration factors, planned top-up forecourts vs total convenience

- Graph: Top 10 occasions purchased for, planned top-ups, forecourts vs total convenience

- Mode of transport to store, top-up planned forecourt vs average convenience

- Meal for Tonight: Quick Solutions on the Go

- Graph: Meal occasion total, daytime meal occasion and meal for tonight, share of forecourt missions with index versus total average convenience, 2023-2025

- Graph: Basket analysis – top 10 categories purchased on meal for tonight missions – forecourt

- Graph: Top 5 locations in store – meal for tonight, forecourt

- Graph: Drivers to store – meal for tonight, forecourt

- Impulse Purchases and Conversion Tactics

Local Distinctions: Urban, Semi-Urban, and Rural Forecourts

- Urban Forecourts

- Graph: Location of forecourt occasions – % share year on year

- Graph: Age of consumer – % share of occasions in forecourts by location

- Semi-Urban Forecourts

- Graph: Location of convenience store comparison and top over-indexing drivers to store – % share of occasions

- Rural Forecourts

- Graph: Services used by consumers in rural locations – occasions %

- Regional Performance and Consumer Preferences

- Graph: Forecourts split by top missions and location – occasions %

- Graph: Top consumption occasions purchased for – Forecourts split by location – occasions %

- Graph: Basket analysis (top five products) – Forecourts split by location – occasions each category features in %

- Graph: Consumer psychographics within forecourts split by location – respondent % agreeing to statement

The Future Outlook for Forecourts

- Market Growth Projections (2025–2028)

- The Evolution of Forecourt Formats

- Digital Transformation and Innovation

- Sustainability and Alternative Fuels

- Graph: In the future do you think electric vehicles will become mainstream, if so, when?

- Changing Consumer Priorities

- Graph: In the next five years, how important will the following services be for your site? – % responding with ‘extremely’ or ‘very important’

ASDA

- Insight into ASDA’s forecourt strategy, including the expansion of the ASDA Rewards scheme.

- Analysis of ASDA’s competitive positioning within forecourt fuel and convenience.

- Consumer insights on ASDA’s forecourt loyalty programme and its impact on shopper behaviour.

BP

- Analysis of BP’s forecourt operations, including the growth of BP Pulse EV charging.

- Insight into the performance of BP’s Wild Bean Café and its food-to-go offerings.

- Evaluation of BP’s partnerships with Costa Coffee and other leading brands.

EG On The Move

- Insight into EG On The Move’s aggressive expansion strategy, including urban and semi-urban locations.

- Analysis of EG’s partnership with Popeyes and other foodservice brands.

- Details on EG’s consumer engagement strategy and its focus on EV infrastructure.

Tesco Express

- Performance analysis of Tesco Express forecourt locations in urban areas.

- Consumer preferences for Tesco’s food-to-go and meal deal offerings.

- Insights on Tesco’s digital engagement and loyalty strategy at forecourts.

Sainsbury’s

- Insight into Sainsbury’s meal deal strategy within forecourts.

- Analysis of Sainsbury’s food-to-go product range and promotional strategies.

- Consumer insights on Sainsbury’s competitive positioning in the forecourt sector.

M&S Simply Food

- Overview of M&S’s premium food-to-go offerings at forecourt locations.

- Analysis of M&S’s partnership with BP and its impact on sales.

- Insights on consumer demand for M&S’s high-quality food options in forecourts.

Shell

- Evaluation of Shell’s partnership with Costa Coffee and its impact on sales.

- Analysis of Shell’s competitive positioning in the forecourt market.

- Insights on Shell’s approach to digital engagement and loyalty.

Gloucester Services

- Insight into Gloucester Services’ award-winning food-to-go and retail strategy.

- Analysis of its focus on locally sourced products and sustainability.

- Details on consumer preferences for premium food options at Gloucester.

Highleadon Filling Station

- Analysis of Highleadon’s focus on local products and artisanal offerings.

- Insight into consumer engagement with local partnerships (e.g., Draper’s Baker).

- Details on how Highleadon positions itself as a community hub.

Childerley Gate Service Station

- Overview of Childerley Gate’s focus on fresh produce and local suppliers.

- Insights on consumer demand for high-quality, locally sourced products.

- Analysis of its role as a rural convenience hub.

Costa Coffee

- Evaluation of Costa’s presence in forecourts through partnerships (e.g., Shell, Tesco).

- Insights on consumer preferences for Costa’s hot drinks in forecourt settings.

- Analysis of Costa’s digital engagement and loyalty strategy.

Charlie Bingham’s

- Overview of Charlie Bingham’s premium ready meals in forecourt convenience.

- Insights on consumer demand for high-quality, convenient meal solutions.

- Analysis of the brand’s competitive positioning in the forecourt market.

Chefes

- Details on Chefes’ premium frozen meal kits and their appeal in forecourts.

- Insights on consumer demand for convenient, premium meal solutions.

- Analysis of the brand’s potential in the forecourt food-to-go sector.

Birdseye

- Evaluation of Birdseye’s frozen product range within forecourt stores.

- Insights on consumer demand for frozen meal options and snacks.

- Analysis of promotional strategies targeting forecourt shoppers.

McCain

- Analysis of McCain’s presence in forecourt convenience stores.

- Insights on consumer demand for frozen chips and ready meals.

- Overview of McCain’s partnerships and cross-category promotions.

Rowntree’s

- Insights on Rowntree’s frozen products within forecourt convenience.

- Analysis of consumer preferences for frozen desserts and snacks.

- Evaluation of brand positioning in the forecourt sector.

Just Eat

- Analysis of Just Eat’s in-car ordering system for EV charging forecourts.

- Insights on consumer engagement with digital food ordering while charging.

- Details on Just Eat’s partnership strategy in forecourts.

Wash.Me

- Insights on Wash.Me’s self-service laundry expansion in forecourt locations.

- Analysis of consumer demand for additional services in forecourts.

- Evaluation of Wash.Me’s competitive positioning.

Gander

- Overview of Gander’s sustainable product offerings in forecourt convenience.

- Insights on consumer demand for reduced-to-clear items.

- Analysis of Gander’s impact on waste reduction in forecourt retail.

Rockfish

- Details on Rockfish’s local seafood offering at Gloucester Services.

- Insights on consumer demand for locally sourced, high-quality food.

- Analysis of Rockfish’s brand positioning in forecourt retail.

Draper’s Baker

- Analysis of Draper’s Baker’s partnership with Highleadon Filling Station.

- Insights on consumer demand for artisanal baked goods.

- Overview of how local partnerships drive footfall in rural forecourts.

Popeyes

- Insights on Popeyes’ partnership with EG On The Move.

- Analysis of the brand’s expansion into forecourt locations.

- Details on consumer preferences for quick-service options in forecourts.

The Buffet Bar and Scotch Egg Bar

- Insights on these innovative food-to-go options for on-the-go consumers.

- Analysis of consumer demand for alternative snack options.

- Overview of their competitive positioning within forecourt retail.

Other Brands Mentioned

- Pepe’s Piri Piri

- Pret A Manger

- WHSmith

- Aldi

- Lidl

- Co-op

Convenience Tracking Programme

Lumina Intelligence’s UK Convenience Tracking Programme (CTP) – survey based data collection with 1,500 responses weekly and 78,000 on an annual basis.

Bespoke Consumer Data Collection

1000 car owners were surveyed in January 2025 with findings compared to January 2024 – responding on their needs within

forecourt settings and their expectations for the future.

Bespoke Operator Data Collection

Leading forecourt operators were surveyed in January 2025 with findings compared to January 2024 – responding on their

sentiments on current trading and what the future will hold (e.g. EV).

Secondary External Sources

Lumina Intelligence also uses external sources including desk research and leading market websites.