The UK Restaurant Market Report 2025 delivers Lumina Intelligence’s authoritative analysis of the £19.0bn UK restaurant industry, providing insight into the trends, challenges, and opportunities shaping the market.

Drawing on Lumina Intelligence’s extensive data sources — including the Eating & Drinking Out Panel, Operator Data Index, and Top of Mind Business Leaders Survey — this report quantifies performance across key segments and explores how consumer, economic, and competitive dynamics are influencing the sector.

With in-depth analysis across market insight, consumer trends, competitive landscape and future outlook, the report helps operators, investors, and suppliers navigate an environment of high costs, selective recovery, and evolving diner expectations.

Who is this report for?

This report is essential for:

- Restaurant operators and groups optimising pricing, menu and estate strategies.

- Investors and analysts seeking a complete view of market value, channel share, and growth potential.

- Suppliers and distributors aiming to understand operator behaviour and consumer demand.

- Hospitality technology providers supporting efficiency, digitalisation, and labour management.

- Consultants and advisors tracking recovery trends and strategic opportunities across foodservice.

Questions This Report Answers

- How is the UK restaurant market performing relative to pre-pandemic levels?

- Which segments and brands are driving growth, and which are in decline?

- How are operators responding to cost pressures and shifting consumer priorities?

- What demographic and behavioural trends are defining dining-out occasions in 2025?

- What are the forecasts and structural challenges for restaurants through 2028F?

- Which innovations and efficiencies are shaping the next phase of service-led dining?

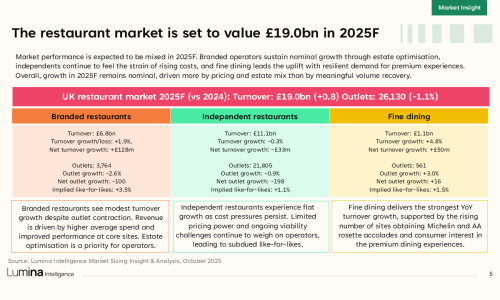

Market Insight

- UK Restaurant Market Overview 2025

- Economic and Trading Environment

- Market Size, Value & Growth Forecasts to 2028

- Inflation, Wage & Cost Pressures

- Channel Comparison: Restaurants vs Fast Food & Pubs

- Branded, Independent & Fine Dining Segment Analysis

- Market Levers of Growth & Inhibitors

Competitive Landscape

- Operator Consolidation & Market Polarisation

- Productivity and Profitability Trends

- Top 10 Branded Restaurant Rankings – by Turnover & Outlets

- Private Equity Investment & M&A Activity

- Brand Refreshes, Repositions & Concept Innovations

- Growth Drivers: Loyalty, Partnerships, and Experiential Marketing

- Cuisine & Concept Trends

- Case Studies

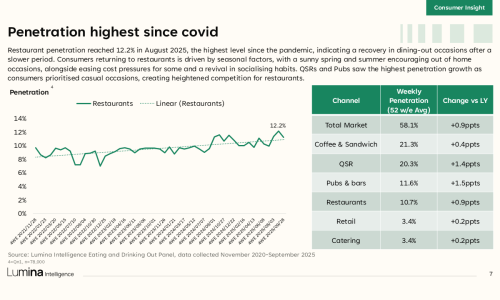

Consumer Insight

- Market Penetration, Visit Frequency & Spend Trends

- Occasion Dynamics: Day-Part, Mission & Social Drivers

- Demographic Focus: 25–34s as Core Growth Segment

- Health, Quality & Value as Key Motivators

- Evolving Food & Drink Preferences: Premiumisation, Quality, and Innovation

- Menu Trends: Functional Health, Artisanal Collaborations & Global Flavours

- Drink Trends: Alcohol Rebound, Curated Cocktails & Mini Serves

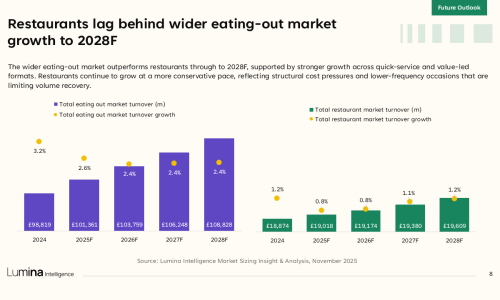

Future Outlook

- Market Forecasts & Growth Prospects to 2028F

- Macroeconomic Outlook: GDP, Inflation & Consumer Confidence

- Segment Trajectories: Branded, Independent, Fine Dining

- Growth Drivers & Inhibitors 2025–2028F

- Emerging Trends: GLP-1s and late night strategies

- Long-Term Structural Challenges & Opportunities

This report is powered by Lumina Intelligence’s market-leading datasets and expertise:

- Market Sizing & Forecasting – Lumina Intelligence Market Sizing Insight & Analysis, 2021–2028F.

- Operator Data Index – Tracking 150 branded restaurant operators across turnover, outlet growth, and financial performance.

- Eating & Drinking Out Panel – Behavioural data from over 78,000 respondents tracking occasions, demographics, and spending habits.

- Top of Mind Business Leaders Survey – Quarterly sentiment survey of hospitality leaders assessing business outlook and key challenges.

- Menu Tracker – Monthly menu analysis capturing pricing, NPD, and category innovation across UK restaurants.

- External Economic Sources – EY ITEM Club, GfK Consumer Confidence, ASDA Income Tracker, and ONS data to contextualise trading conditions.